Study: At 70% of U.S. Colleges, Tuition and Fees Are Higher Than Undergrad Loan Limits

For college students paying for their degrees with loans, federal student loan limits can be a rude awakening.

These limits on Direct Subsidized and Unsubsidized Loans are set by Congress and were last increased a decade ago. Meanwhile, college tuition rates at public four-year colleges have risen by 37% in the past 10 years, based on figures from The College Board.

With costs rising and borrowing limits remaining static, students are often left scrambling to cover all their expenses. How does student access to loans measure up to college prices? To find out, we compared the costs at over 1,700 U.S. colleges to federal student loan limits for undergraduates.

Key findings: Student loan limits don’t match college costs

- College costs are outpacing federal student loan limits. Undergraduates can only borrow between $5,500 to $12,500 in federal loans per academic year. Yet only 1.55% of U.S. colleges have tuition and fees low enough that a dependent freshman could afford them using only these loans.

- Tuition and fees exceed federal loan limits by $11,000 or more. Even after maxing out federal student loans, the remaining costs were significant: $11,177 up to $18,177, on average.

- Independent students’ access to higher loan limits makes a difference. Independent students, especially those in their third and fourth years, were more likely to be able to borrow enough to cover college costs. Three in 10 colleges charged tuition and fees that could be covered by the $12,500 loan limit offered to these students.

Federal student loan limits for undergrads range from $5,500 to $12,500 per year

Direct Subsidized and Unsubsidized Loans are the only federal student loans offered directly to undergrad students. But these students can only borrow up to certain annual limits.

Annual undergraduate limits for Direct Loans

| Dependent students | Independent students | |

|---|---|---|

| Freshmen | $5,500 | $9,500 |

| Sophomores | $6,500 | $10,500 |

| Third year+ | $7,500 | $12,500 |

Dependent students in their first year can borrow the least, with an annual federal student loan limit of $5,500. Independent upperclassmen, on the other hand, can access as much as $12,500 in Direct Loans per academic school year.

Another limit applies, as well: the college’s reported cost of attendance. Students cannot borrow more than what a college estimates it should cost to enroll in and attend its programs.

Students can only borrow up to their cost of attendance or Direct Loan limit, whichever is lower.

College costs are higher than what students are allowed to borrow

It’s rare to find a four-year U.S. college where the cost of attendance is lower than the limits set on Direct Subsidized and Unsubsidized Loans.

The average college cost for an in-state student at a four-year public institution, for example, is $9,650.

That’s well above the borrowing limits for dependent students, and just above the limit set for independent freshmen. But that figure doesn’t even include other expenses that are often associated with the cost of attendance, such as room and board, transportation, textbooks, and other school supplies.

This means that even if undergraduates max out their available federal student loans, many will still have college costs left over to cover. And they’ll have to look to other funding sources to figure out how to pay for college.

70% of colleges’ tuition and fees exceed undergrad borrowing limits

For students who plan to only borrow enough to cover educational costs, will Direct Subsidized and Unsubsidized Loans be sufficient?

In our study, we wanted to see how the cost of attendance at different colleges compares to federal limits on undergraduate student loans. To do so, we surveyed the annual education expenses at 1,744 U.S. colleges that grant four-year degrees or equivalent certifications. Specifically, we looked at tuition, fees, and textbook costs.

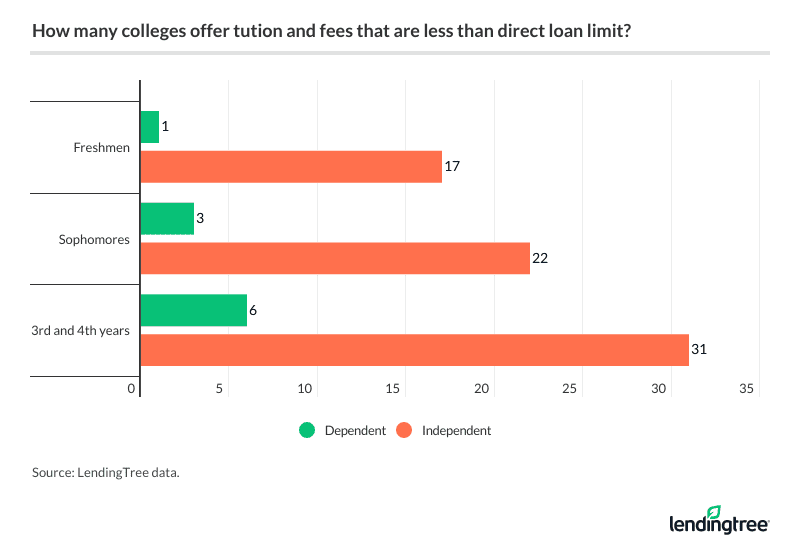

The results reveal that few colleges have tuition and fees that a student can cover with Direct Subsidized and Unsubsidized Loans alone. Here’s the percentage of colleges at which costs fall below undergrad student loan limits.

6% of colleges have tuition and fees that fall below dependent student borrowing limits

Most college students under 24 are considered dependents under federal student aid rules. As a result, they’ll face lower borrowing limits. Yet the number of colleges at which these dependent students can use their Direct Loans to fully cover costs is shockingly low.

Just 27 colleges, or 1.55%, have costs that dependent freshmen can cover with Direct Loans. For dependent upperclassmen, this amount increase to 104 colleges (6%).

Here are the 27 colleges at which tuition and fees fall below borrowing limits for undergraduate students.

| Berea College in Berea, Ky. | Indian River State College in Fort Pierce, Fla. | Aspen University in Denver |

| College of the Ozarks in Point Lookout, Mo. | The Colburn School Conservatory of Music in Los Angeles | Georgia Gwinnett College in Lawrenceville, Ga. |

| Brigham Young University–Idaho in Rexburg, Idaho | Ohio University–Lancaster in Lancaster, Ohio | Nevada State College in Henderson, Nev. |

| Valencia College in Orlando, Fla. | Palm Beach State College in Lake Worth, Fla. | Brooklyn College in Brooklyn, N.Y. |

| State College of Florida Manatee-Sarasota in Bradenton, Fla. | Abraham Baldwin Agricultural College in Tifton, Ga. | Columbia Southern University in Orange Beach, Ala. |

| New Charter University in Salt Lake City | Ohio University–Chillicothe in Chillicothe, Ohio | Elizabeth City State University in Elizabeth City, N.C. |

| Polk State College in Winter Haven, Fla. | Shiloh University in Kalona, Iowa | Simmons College of Kentucky in Louisville, Ky. |

| St. Petersburg College in St. Petersburg, Fla. | Apex School of Theology in Durham, N.C. | Harrison Middleton University in Tempe, Ariz. |

| Alice Lloyd College in Pippa Passes, Ky. | Midwives College of Utah in Salt Lake City | Dalton State College in Dalton, Ga. |

Independent students can borrow enough to pay tuition at 30% of U.S. colleges

On the other end, however, the $12,500 limit for independent upperclassmen is high enough that far more colleges pass this bar. Of the 1,744 colleges surveyed, 532 (30.5%) charge tuition and fees low enough that these students can pay them with Direct Subsidized or Unsubsidized Loans alone.

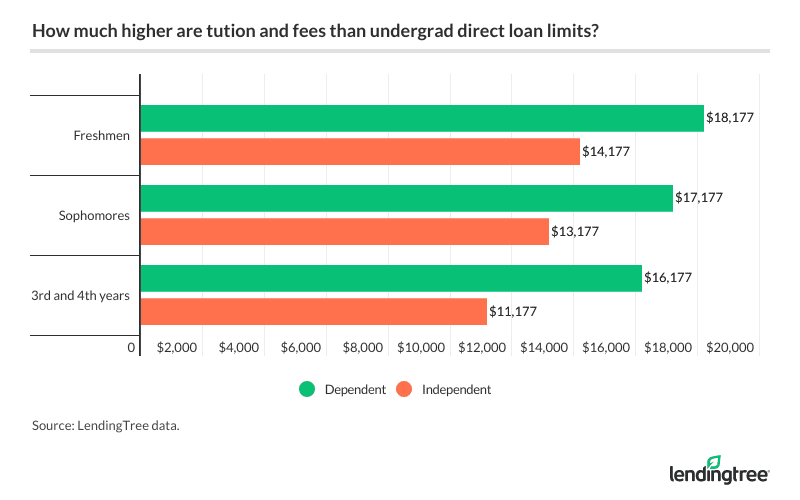

After maxing out loans, undergrads’ remaining tuition and fees are $11,000 or more

Surprisingly, few colleges have educational costs that students can cover with federal student loans. But on top of this, the gap between what students can borrow and the tuition, fees, and textbook costs they must pay are staggeringly high.

Here’s how much college tuition and fees exceed student loan limits, on average.

Among all classes, dependent freshmen see the largest gap between college costs and Direct Loan limits. If these students borrow the maximum $5,500, they’ll still face $18,177 in additional educational costs, on average.

Independent juniors and seniors are the best off, with the option to borrow up to $12,500 in Direct Loans per academic year. Yet even these students will have $11,177 in remaining costs after borrowing the maximum amount in federal loans.

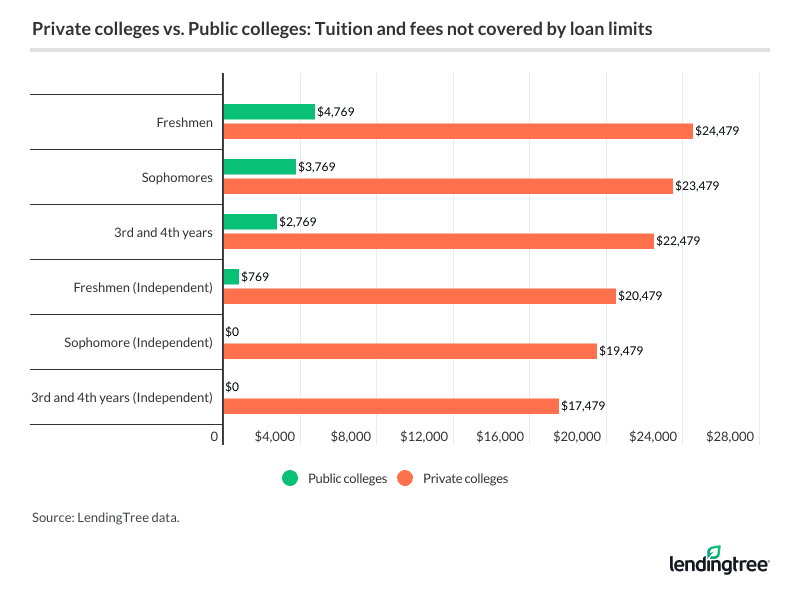

Paying with federal loans? Choose a public college

If you’re a college applicant planning to pay for school primarily through Direct Subsidized and Unsubsidized Loans, your funds will go much further at a public college versus a private college, our study reveals.

Subsidized by state or local governments, public colleges are more affordable than colleges owned and operated by private entities. Our recent college cost study found that a course credit is priced 3.2 times higher at a private institution than at a four-year public school.

With lower prices, this also means that public colleges are more likely to have tuition costs that fall below federal borrowing limits, our study found. This assumes, however, that the students pay in-state rates.

How Interest Rates Affect Your Personal Loan Repayment

| Loan Balance | Repayment Term | Interest Rate | Monthly Payment | Total Repaid | Interest Charges |

|---|---|---|---|---|---|

| $23,000 | 5 Years | 35.00% | $816 | $48,977 | $25,977 |

| $23,000 | 5 Years | 5.00% | $434 | $26,042 | $3,042 |

Even among public colleges, the portion of schools at which students can cover costs with only Direct Subsidized and Unsubsidized Loans is low. Just 2.5% of public colleges have costs of attendance below the $5,500 borrowing limit for dependent freshmen.

But for independent students, public college costs are much more manageable. Independent upperclassmen’s $12,500 in student loans would be enough to cover costs at about 80% of public colleges.

These figures are abysmal at private colleges, however. The borrowing limit for Direct Subsidized and Unsubsidized Loans cover educational costs at 1.18% of private colleges if you’re a dependent freshman. For independent upperclassmen, those loans would cover costs at 7.35% of private colleges.

Students at public colleges will also face much smaller gaps between available loans and leftover tuition and fees. In fact, the average independent sophomore, junior, and senior will face tuition and fees below their loan limits.

At private colleges, however, dependent freshmen face $24,479 in average costs above their $5,500 loan limit. That’s $19,710 more per year than the average costs a dependent freshman at a public college would face after maxing out their loans.

How students can cover their leftover college costs

Overall, this study reveals a shockingly wide gap between the federal funding offered to undergraduates and the costs these students face. More of today’s students are unable to cover all their college costs by borrowing federal student loans.

When students max out their federal loans, they have to look for other ways to pay for college:

- In addition to loans, other forms of student aid can be a huge help in paying for college. The average student aid gifted to a public college student was $7,010 in 2014-2015. Private college students received $19,960 on average. Students should file the FAFSA to be considered for federal grants. They should apply for state and private scholarships, too.

- Parent PLUS Loans are another common solution for students whose costs are higher than what they can borrow. These are federal student loans offered to parents of college students. Parents can borrow up to the student’s cost of attendance minus other aid. However, PLUS Loan interest rates and fees are higher than those charged to undergrads.

- Private student loans are another way to borrow more money for college. Unlike federal student loans, however, private lenders will require a good credit score and solid borrowing history from applicants. Students will likely need to apply with a cosigner to qualify for a private loan.

- Raising your federal student loan limits might also be an option. See if you can meet the requirements to be considered an independent student on the FAFSA. Dependent students can also borrow up to the limits set for independent students if they have a parent who was denied a Parent PLUS Loan.

Overall, our study underlines the fact that the federal student loans offered to undergraduates are often insufficient to cover college costs. While Congress might take on the task of adjusting student loan limits at some point, it’ll largely be up to students to find a way to afford college.

The best way to do so is to learn about these limits and find alternatives to student loans. Students and parents who are aware of the discrepancy between college costs and loan limits will be better prepared to find other ways to pay for a degree.

Methodology

LendingTree surveyed the costs at four-year colleges in the U.S. based on the most recent data supplied by Peterson’s. Educational costs including tuition, fees, and textbooks were compared to federal borrowing limits on Direct Subsidized and Unsubsidized Loans for undergraduates. Only colleges in the 50 states and D.C. with complete pricing data were included in the 1,744 colleges analyzed in this study.