Are Student Loans Bad or Good Debt? Here’s What You Need to Know

Are student loans good, or are student loans bad? Are they a big benefit, or do they just add up to one poor investment?

In reality, they can be both. Good student loan debt could deliver a college degree to help you climb the career ladder. Bad student loan debt can leave you ill-equipped for repayment, harming your finances for years to come.

To get a handle on the upsides and downsides of student loans and other debt, let’s review the following:

Good debt vs. bad debt

What makes debt good?

What is good debt, exactly? It’s about borrowing money for something that will appreciate or increase in value and make your loan worth the investment in time and money.

Mortgages: Home loans might be considered a “good” type of debt. Unlike a car, which loses value the moment you drive it off the lot, a house will (hopefully) increase in market value over time. If you sell it years down the line, you’ll (ideally) net enough of a profit to offset some of the principal and interest you’ve paid on the loan.

Small business loans: Entrepreneurs who borrow may also be staying on the good side of debt, since the money they put into paying for overhead, office space, equipment, employee training and salaries should pay off over time if their venture is a success.

Leslie Tayne, a debt resolution attorney at New York-based Tayne Law Group, described good debt as “a debt that you can easily maintain in your budget and debt that has given you a benefit.”

Basically, good debt will allow you to “be thankful for what debt has allowed you to have,” she told LendingTree.

What makes debt bad?

In a nutshell, bad debt is borrowing money to pay for something that diminishes or drops in value over time.

Auto loans: Not only does potentially high interest add to the total amount of principal borrowed, but the car you bought is usually a depreciating asset. In this case, buying a car via an auto loan might just be adding extra interest costs on top of the maintenance, insurance and gas that normally add to the ongoing price of the car.

Credit cards: This can be a good form of revolving debt but might become “bad” if you let your balance build up, making the interest unmanageable. Although some cards come with rewards and perks, they may or may not be worth it if you end up paying a bundle in interest.

Payday loans and cash advances: Other debt like these products often come with insanely high interest rates that can eat your budget up alive. Likewise, big-ticket purchases that need to be financed — like luxury items you don’t need — can be considered bad debt since they don’t appreciate in value.

“Debt is only bad when it becomes unmanageable, out of your budget and you can no longer pay it,” said Tayne. “It can also include debts that simply don’t make sense or debt you didn’t even intend to take on.”

So, are student loans bad or good?

In the good debt versus bad debt debate, student loans fall into a gray area. They can be considered good debt because the money you’re borrowing to attend school is your ticket to earning a degree and getting hired at a well-paying job. That debt should pay itself off over time with a lucrative career in place.

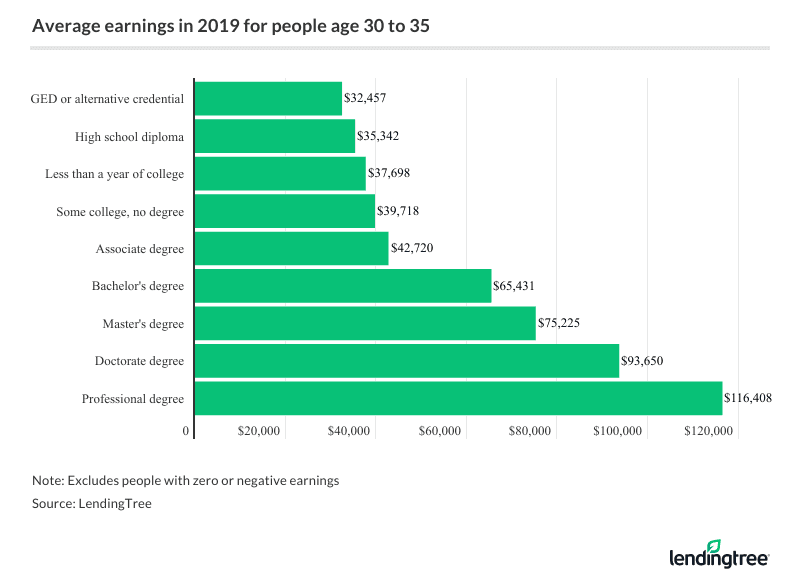

In fact, having a college degree significantly increases your income potential, as compared to peers with less education, according to LendingTree research.

On the other hand, student loans can be bad because that degree does not guarantee employment. Student loan debt currently exceeds the $1.64 trillion mark, with more than 45 million borrowers faced with repaying their obligation, according to our student loan debt statistics.

Even though unemployment for college graduates has been historically low, it doesn’t always stay that way. The Great Recession in 2008 and the coronavirus pandemic erupting in 2020 both worsened the job market for new and recent grads. Even those ex-students who find work more easily than their peers may not earn the kind of salary that makes repaying student debt easy.

In fact, student loans may be the hardest type of debt to narrow down to simply “good” or “bad,” since everyone’s financial and lending needs may differ. Instead, let’s consider both the benefits and drawbacks to student loans.

Is student loan debt good? Yes, when …

- Student loans allow you to pursue a college education without having to pay for your entire tuition in full. With a college degree, you improve your chances of finding well-paying, stable employment.

- Some federal loans are subsidized. If you qualify, you’ll have your interest paid during select periods of time.

- Interest rates on federal loans are currently lower than most other lending products, and the interest is tax-deductible.

- Federal student loans come with a variety of repayment plans (standard, graduated, extended, income-driven, etc.) that can make your loan payments easier to align with your budget.

- You have opportunities to refinance your student loans if you’re struggling with debt — and with federal loans, you have additional options, including mandatory forbearance and various loan forgiveness programs.

- With timely, disciplined payments, student loans can add positively to your credit history and score.

Is student loan debt bad? Yes, when …

- Even though a college education improves your career chances, you still might find yourself unemployed after graduation.

- Entry-level workers fresh out of college also may not earn enough to comfortably afford their loan repayments. Plus, the high amount of debt compared to a lower salary can produce a skewed debt-to-income ratio, which can hurt your credit.

- Unaffordable student loan debt can lead to delinquency and even default, which can ruin your credit score and prevent you from getting approved for other types of credit.

- Student loans have been historically difficult to discharge in bankruptcy, requiring you to prove that paying off the debt would cause you undue hardship.

How to make student loans into good debt

The most certain way to make student loans into good debt is by having enough money on hand to pay down the majority of your interest before it accrues — but if that were the case, there wouldn’t be much of a reason to take out a loan in the first place.

A look at the above pros and cons may leave you wondering: Should I get student loans? From a financial standpoint, it’s often a necessary evil for students who don’t have the luxury of grants and scholarships, family money or other sources of money for college.

Borrowing money for student loans may be unavoidable, but by managing your debt carefully, you can shift it from bad to good.