Your Complete Guide to State Financial Aid Grants

About 57% families used at least one grant to help pay for college during the 2018-19 academic year, according to a 2019 Sallie Mae report — as a result, 49% of those families didn’t have to borrow student loans.

Whether they come from the federal government, your school or another organization, grants are hugely important because they can lessen the amount you need to borrow for loans, and in some cases even replace loans altogether.

Although state grants for college are typically need-based and determined by your FAFSA, they’re another great way to save you money. To help get a handle on this, we’ve assembled a complete list of all 50 states and the District of Columbia with the major awards available for each, so you can see what grants are out there.

How to find state grants for college

The federal government’s four grants for college and graduate students can all be found under the same roof: the Department of Education. But there are a few different ways to find state grants for college.

Like with scholarship opportunities, you’ll want to be aware of grant application deadlines and eligibility rules. These programs are typically (but not always) restricted to residents attending qualifying in-state schools, for example.

In some cases, you might apply to the state’s education department; in others, you may need to apply directly with your school or by listing the school on your completed FAFSA. Almost all state grants require filling out the FAFSA.

Additionally, many states exclude applicants who have defaulted on a student loan.

Whether you’re a wide-eyed freshman, a graduate or professional student or an adult going back to school, here’s a rundown on state grants for college.

Alabama

There are two grants available via the Alabama Commission on Higher Education. Both require residency and are awarded based on financial need. The Assistance Program Grant hands out between $300 and $5,000 per student, and the Alabama Student Grant comes with a reward of up to $1,200 per year.

Alaska

Awards ranging between $500 and $4,000 are given to undergraduates via the Alaska Education Grant. The state’s legislature prioritizes students with the most financial need first, then works its way down to those students who may be able to contribute more to their education until the funds are exhausted. Recipients could receive as much as $16,000 during their undergraduate education.

Arizona

The Arizona Commission for Postsecondary Education has eliminated four of its state grant programs in recent years, but still offers one for students with financial need. Through the Arizona Leveraging Educational Assistance Partnership, participating state schools can offer high-need undergraduates as much as $2,500 per year, though the average award is generally around $1,000.

Arkansas

The state’s education department has grants for three different kinds of students:

- Future Grant: Students seeking in-state certificates and associate degrees in high-demand fields like science, technology, engineering and math from qualifying programs

- Health Education Grant: Graduates pursuing professional medical degrees from one of 77 eligible out-of-state schools

- Teacher Opportunity Program: Teachers furthering their education with access to as much as $3,000 in reimbursement grants per year

California

California awards more grant aid to low-income students than its federal Pell Grant expenditure — and the most among all states, according to a 2017 study performed by the University of California at Berkeley — and it has the grant programs to prove it.

Aside from Cal Grant Programs — a collection of awards for undergraduates— the state also offers the California Chafee Grant Program, targeted toward youth in foster care. Additionally, the state provides funds for students in financial need via the California Dream Act.

Colorado

Beyond offering tuition assistance to the families of military members and public servants, Colorado has two grants for undergraduate and graduate students who demonstrate financial need via the FAFSA.

Connecticut

Via the state’s Roberta B. Willis Need-Based Grant Program, high school seniors and graduates could receive up to $4,500 for study at a public or private nonprofit two- or four-year school in the state.

To qualify, Connecticut residents must have an expected family contribution within the state’s allowable range.

Delaware

The Delaware Department of Education’s Higher Education Office offers the Scholarship Incentive Program, which gifts undergraduate and graduate students who have performed high but also have financial need with $1,000 awards. There is a minimum grade point average requirement of 2.5.

There is a second grant for Delaware residents on offer, established for the children of deceased veterans of the military, state police or Department of Transportation.

District of Columbia

The nation’s capital offers the DC Tuition Assistance Grant (DCTAG) in the form of two annual awards:

- Up to $10,000 toward the difference between in-state and out-of-state tuition at public schools

- Up to $2,500 toward tuition at private schools in D.C. and private Historically Black Colleges and Universities throughout the country

The grants are restricted to undergraduates 26 or younger who are attending qualifying schools.

The DC Mayor’s Scholars Undergraduate Program also awards up to $4,000 per student annually. However, it serves as a last-dollar award, meaning that it would cover any gap in your cost of attendance after all other financial aid is accounted for.

Florida

Students seeking grants from the state of Florida are instructed to complete both the FAFSA and the state’s Florida Financial Aid Application (FFAA). The FFAA isn’t required for all grants, but it does keep all of thefollowing options open:

- Access to Better Learning and Education Grant

- First Generation Matching Grant

- Florida Student Assistance Grant

- Florida Public Postsecondary Career Education Student Assistance Grant

- José Martí Scholarship Challenge Grant

Georgia

The Georgia Student Finance Commission manages five state-funded scholarships and grants. In addition to grants with ties to the military and the families of public servants, the Tuition Equalization Grant Program helps all students, regardless of need, afford the cost of attending private schools in the state.

The REACH Georgia program is a needs-based scholarship that might be a better fit for low-income students attending any school in the state. Beyond a maximum four-year scholarship of $10,000, the program also provides on-campus mentoring.

Hawaii

In this state, visiting your campus financial aid office is your best bet. Low-income residents can apply through their schools for Hawaii-funded Opportunity Grants, which can help cover tuition, but not fees.

Idaho

The Idaho State Board of Education awards seven state-funded scholarships. Although none of them are grants by name, four of the scholarships are need-based. That said, they do still have some merit-based requirements.

The Idaho Opportunity Scholarship (2.7 grade point average), the Idaho Opportunity Scholarship for Adult Learners (2.5) and the Tschudy Family Scholarship (2.6) have academic performance rules. Only the GEAR UP Idaho Scholarship 2 does not take merit into account.

Illinois

Illinois offers grants for students with connections to veterans, national guardsmen and dependents of police, fire and correctional officers. If you don’t fall into those groups, you might receive aid through these two grant programs:

- Higher Education License Plate Program: When Illinois residents buy license plates featuring their alma maters, the proceeds fund this program for prospective or current students of the same school. The number of awards varies by year.

- Monetary Award Program (MAP): Undergraduates with financial need attending approved in-state schools can receive aid for their tuition and mandatory fees. The Illinois Student Assistance Commission provides a calculator to help estimate your award — see the MAP Estimator on the ISAC Student Portal.

Indiana

Among the state’s many aid options, EARN Indiana is a work-study program for students from low-income families. Students who participate in EARN Indiana earn paid internships.

Students with financial need also have three grant opportunities at their disposal:

- Frank O’Bannon Grant: Undergraduates with financial need can earn awards tied to their expected family contribution (EFC). A student with an EFC of $0 in 2020 could receive between $2,900 and $9,200 depending on their school choice.

- Adult Student Grant: Working adults can receive a $2,000 grant toward starting or continuing their education. The program was created in 2015 to meet the needs of approximately 750,000 Indiana residents with some college experience but no degree.

- Workforce Ready Grant: This program covers the tuition and some fees for working-age residents pursuing a certificate at Ivy Tech Community College or Vincennes University, among other approved programs.

Iowa

The Iowa College Student Aid Commission manages a handful of assistance programs for residents, including three grants with varying purposes:

- Iowa Tuition Grant: By filling out the FAFSA, Iowans are automatically drawn into consideration for this award, which helps to cover tuition at any school in the state.

- Iowa Vocational-Technical Grant: Students attending a career or technical education program at Iowa community colleges could receive $900 per year.

- Kibbie Grant (Iowa Skilled Workforce Shortage Tuition Grant): Also for two-year school students, this grant maxes out at half of the average Iowa community college’s tuition cost and mandatory fees.

Kansas

Beyond its scholarships, Kansas has two grants for different groups of students:

- Kansas Career Technical Workforce Grant: All in-state students pursuing a technical certificate or an associate of applied science degree can apply, but students with financial need will see the $1,000 benefit first.

- Kansas Comprehensive Grant: n-state students with financial need can receive between $100 and $3,500 depending on their school type and income level. The state estimates that because of a lack of funding only one in three eligible applicants will receive aid.

Kentucky

In conjunction with 10 state-funded scholarships, Kentucky’s Higher Education Assistance Authority provides two grant opportunities with varying maximum awards: the College Access Program Grant ($2,000) and the Tuition Grant ($3,000). Each grant prioritizes financial need for resident undergraduates.

Louisiana

Among its many forms of support for higher education, Louisiana has one grant opportunity for its residents. The GO Grant aims to help “nontraditional and low to moderate-income students” in the words of the state’s Office of Financial Assistance.

The individual grant awards range from $300 to $3,000 per year. Students must receive a federal Pell Grant to be eligible for the GO Grant.

Maine

Maine’s financial aid for residents includes scholarships, loan forgiveness programs and tuition waivers — among its highlights is the Maine State Grant Program.

Through the program, students from low-income families could qualify for aid to attend any school in the state. For the 2020-21 academic year, students with an expected family contribution below $4,500 could receive up to $1,500 in support.

In addition, there’s a Maine State Grant Program for Adult Learners that awards up to $1,500 for students born on or before Jan. 1, 1996.

Maryland

Aside from its menu of need-based scholarships, Maryland has three grants as part of its Howard P. Rawlings Program of Educational Excellence Awards, as well as a separate grant program for part-time students:

- Guaranteed Access Grant: High school seniors who apply must come from a family that makes less than 130% (new applicants) or 150% (renewing applicants) of the state’s poverty-level income. The renewable grant has a maximum award. For the 2020-21 academic year, it was $19,100.

- Educational Assistance Grant: Undergraduate students who have financial need could receive between $400 and $3,000 per year.

- Campus-Based Educational Assistance Grant: Students who have financial need, but were ineligible for the Educational Assistance Grant because they didn’t file the FAFSA on time, can receive up to a $3,000 award through their school.

- Part-time Grant: For students who are using dual enrollment to attend both a Maryland high school and public college or university can access this grant worth between $200 and $2,000.

Massachusetts

The state’s Department of Higher Education offers seven grants through theOffice of Student Financial Assistance:

- Foster Child Grant: Students under the age of 25 can receive up to $6,000 toward the tuition of any U.S. school.

- MASSGrant: Students with an expected family contribution between $0 and $5,486 can qualify for aid to attend approved schools in Massachusetts, Vermont, Pennsylvania and Washington, D.C.

- Gilbert Matching Student Grant: Schools can pull from the commonwealth’s fund to award students with financial need between $250 and $2,500 per year.

- Cash Grant: Students already receiving tuition assistance because of financial need can qualify for this grant to cover additional educational expenses.

- Part-Time Grant: Students with financial need that are returning to school on a part-time basis can receive at least $200 in aid.

- Public Service Grant: Not based on financial need, this program covers the full tuition charges of children and spouses of deceased public servants, such as police officers, firefighters and military veterans.

- Paraprofessional Teacher Preparation Grant: Students seeking their teacher’s license could receive between $4,000 and $7,500 per year, depending on their school choice.

Michigan

In addition to grants for children of the state’s veterans, as well survivors of its police officers and firefighters, the Michigan Tuition Grant serves students with financial need. The program offers a maximum award of $2,800 to students attending nonprofit schools in Michigan.

Minnesota

Using the Minnesota State Grant, undergraduate students with financial need can receive an average award of $2,603, which students can apply forby filling out the FAFSA. Undocumented students ineligible to fill out the FAFSA are instructed instead to fill out the state’s Dream Act application.

Here are four more Minnesota-funded grants for more specific situations:

- Child Care Grant: Residents pursuing post-secondary education who have children 12 or younger could receive up to $5,200 per year per child to assist with child care costs.

- Minnesota Teacher Candidate Grant: Aspiring teachers intending to work in an underserved area of the state could receive aid worth $7,500 per term.

- Public Safety Officer’s Survivor Grant: Receive an annual tuition-and-fees pledge of up to $5,963 (for a two-year school) or $15,142 (four-year programs) if your loved one died in the line of duty.

- Grants for Students with Intellectual and Developmental Disabilities: Award amounts vary for eligible students attending Bethel University (St. Paul, Central Lakes College (Brainerd) or Ridgewater Community College (campuses in Willmar and Hutchinson).

Mississippi

The state’s Institutions of Higher Learning offers two grants for undergraduate students attending any school in the state. Unlike many grants in other states, they’re partly merit-based.

Mississippi’s grants include:

- Tuition Assistance Grant: Requires applying students to record a high school grade point average of at least 2.5 or an ACT score of at least 15 to receive between $500 and $1,000 per year

- Eminent Scholars Grant: Requires applying students to record a high school grade point average of at least 3.5 or an ACT score of at least 29 (or SAT score of at least 1350) to receive up to $2,500 in aid per year

Missouri

The state offers financial aid for military and public service families as well as need-based scholarships for minorities and other groups. The state’s two grant programs each serve a unique purpose:

- Advanced Placement Incentive Grant awards $500 to high school students who score well on advanced placement tests in mathematics and science.

- Access Missouri Financial Assistance Program was designed for public school undergraduates who register an expected family contribution of less than $12,000. Students attending a four-year school could receive between $1,500 and $2,800 in aid — two-year attendees could score between $300 and $1,300.

Montana

A new addition to this list, thanks to $4 million in state funding approved for 2020 and 2021, Montana currently has a state-funded, school-awarded grant called Investing in Student Success. The opportunity is meant for students with financial need who are federal Pell Grant-eligible, although the awarding schools also maintain academic criteria as well.

Nebraska

The Nebraska Opportunity Grant is funded by the state but paid out by its schools. Priority is determined by the expected family contribution calculated from your FAFSA. The average award during the 2018-19 school year was $1,410. About 63% of the aid was doled out to families with household incomes below $40,000.

New Jersey

To qualify for the state’s Tuition Aid Grant (TAG), students must meet traditional grant requirements, including residing in the state for at least a year. The award varies depending on your school.

During the 2019-20 academic year, students would receive between $2,712 and $12,798, depending on their school choice. Use the state’s TAG Award Estimator to figure your potential amount.

New Jersey also operates an Educational Opportunity Fund Grant for disadvantaged students that provides $200 to $2,650 for expenses — like room and board — left uncovered by TAG. After completing the FAFSA, ask your (prospective) college financial aid office about your eligibility.

New Mexico

In Sept. 2019, New Mexico Gov. Michelle Lujan Grisham announced a groundbreaking program that would make the state the first to offer tuition-free college for all residents, regardless of income. That program has yet to become the law of the land, however.

In the meantime, New Mexico’s Higher Education Department offers an annually renewable grants for residents attending public schools in the state, called the Incentive Grant Program. For students with “substantial financial need,” this grant comes with $200 to $2,500 in aid per year.

New York

In 2017, New York became the first state to offer free public college tuition via its Excelsior Scholarship program. However, even if you qualify for that form of gift aid, it won’t cover room and board.

The state encourages you to visit your school’s financial aid office to learn about its Educational Opportunity Program. To receive the grant, which comes with financial assistance and academic support, a student’s household income is measured. A family of four, for example, must earn less than $47,638 to be eligible for the 2020-21 school year.

The Aid for Part-time Study program could be a better fit if you’re going to school with a light course load: It features up to $2,000 in annual support.

North Carolina

The state’s College Fund of North Carolina instructs resident students to fill out the FAFSA, listing out their preferred in-state schools and simply wait to hear back. There are no formal applications necessary for its grant offerings.

Depending on your family’s income level and whether you’ll be attending a two- or four-year school, you might find yourself receiving aid through the NC Community College Grant Program or the North Carolina Need Based Scholarship.

North Dakota

The North Dakota State Student Incentive Grant Program delivers up to $1,100 per semester or $733 per quarter for undergraduate students studying locally. Qualifying students will be notified as long as they have completed the FAFSA.

Ohio

Among its many forms of financial aid, the state’s College Opportunity Grant is open to undergraduate students with an expected family contribution below $2,190 and a household income under $96,000, if they are studying at an eligible school in Ohio or neighboring Pennsylvania. The annual application deadline is Oct. 1.

More recently, Ohio’s Department of Natural Resources started its Geological Survey Grant Program, which awards a pair of $1,200 grants to earth science students performing graduate-level research at state schools.

Oklahoma

In addition to offering a handful of scholarships, the state touts its Oklahoma’s Promise initiative. Formerly known as the Oklahoma Higher Learning Access Program, it guarantees need-based scholarships for families with income of $55,000 or less. The program helped 15,935 students afford college during the 2018-19 academic year.

Oregon

The state’s Office of Student Access and Completion has five grant opportunities, including programs for foster children, children of deceased or disabled public safety officers and students who are parents.

The office’s other grants include:

- Opportunity Grant: Students with a sub $3,500 expected family contribution could receive as much as $3,600 per year. Awards are reserved for the neediest applicants, not the fastest to apply.

- Promise Grant: Students with a sub-$34,000 expected family contribution could receive between $1,000 and $4,005 toward community college tuition. The student must leave high school with at least a 2.5 grade point average.

Each grant requires filling out the FAFSA, but the state also set up the Oregon Student Aid Application (ORSSA) for undocumented immigrant students living in the state.

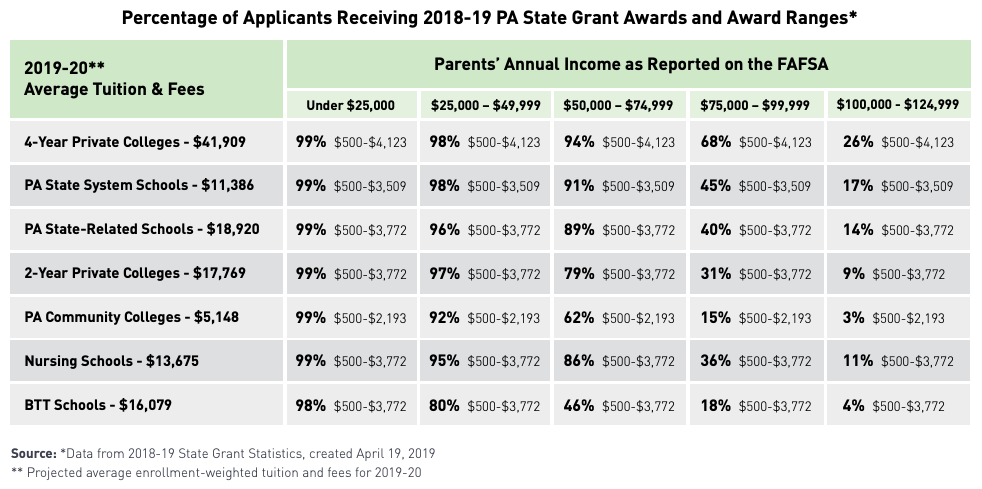

Pennsylvania

The Pennsylvania State Grant Program was designed to assist students with financial need in the state. During the 2019-20 academic year, recipients could expect to receive up to $4,123 per year in aid, depending on family income and their choice of school.

There’s an annual May 1 deadline to complete the state’s application forms.

Rhode Island

In January 2017, the smallest state in America expanded its RI Promise program to offer all graduating high school students a free community college education. Known as a last-dollar scholarship, it fills in the gap after other gift aid has been tallied, leaving few students in need of Rhode Island student loans.

South Carolina

Aside from its scholarship and tuition assistance programs, the state’s Commission on Higher Education set up its need-based grant program for undergraduates. Participating public schools determine each recipient’s award after accounting for all other gift aid. Full-time students could receive as much as $2,500 per year. Part-time students are eligible for up to $1,250.

South Dakota

South Dakota’s Need Based Grant Program gives 16 participating in-state schools funds to dole out each year. Each school could award between $500 and $2,000 to low-income students.

Tennessee

There are six unique grant programs among the financial aid initiatives run by the Tennessee Student Assistance Corporation. The half-dozen programs include grants for foster children and military veterans. Here are the remaining four grant opportunities:

- Student Assistance Award: Undergraduates with an expected family contribution below $2,100 could receive up to $4,000 to attend eligible schools.

- HOPE Access Grant: Incoming freshmen with a minimum 2.75 grade point average and an ACT score of at least to 18 to 20 are eligible for per-semester amounts of $1,250 (at four-year schools) and $875 (two-year schools).

- Dual Enrollment Grant: High school juniors and seniors taking college courses for credit can receive between $100 and $500 per hour of class.

- Reconnect Grant: For part-time, independent students — adults returning to school, perhaps — who have established residency in the state.

Texas

Besides offering need-based scholarships, the state’s Higher Education Board highlights four grant opportunities on its “College for All Texans” website. Each one requires students to maintain a 2.5 grade point average in college.

- Texas Educational Opportunity Grant Program (TEOG): Up to $5,876 per year for students attending two-year colleges.

- Texas Public Educational Grant Program (TPEG): Completing the FAFSA will automatically ensure that your school considers your eligibility.

- Toward EXcellence, Access and Success Grant Program (TEXAS Grant): Up to $4,896 per semester for eligible students.

- Tuition Equalization Grant Program (TEG): For students attending private, nonprofit colleges or universities in Texas, as much as $3,420 of support could be available annually.

Vermont

With two main grant options for two academic paths: The Vermont Grant for college and the Short-term Training Grant for non-degree programs. Vermont asks for applicants with financial need to fill out online applications for its awards. Each candidate is considered on a rolling basis, so it’s wise to apply as early as possible.

Virginia

Virginia has a few active grant programs, highlighted by the Virginia Tuition Assistance Grant Program for attending private schools. Undergraduate and graduate students must submit application forms to access as much as $3,400 and $1,700, respectively.

Other grant programs include:

- Two-Year College Transfer Grant: Students with associate’s degrees can qualify for as much as $1,000 to $2,000 when transitioning to qualifying four-year schools.

- New Economy Workforce Credential Grant: Students attending a non-credit training program can have up to two-thirds of the tuition covered.

Washington

The Washington College Grant, which replaced the similarly-functioning State Need Grant in 2019, aims to help the lowest-income students. To be eligible, students must come from a family with relatively low household income. A family of four, for example, must earn $64,000 or less.

The grant award depends on the school you attend — as an example, University of Washington students could receive up to $10,748, Evergreen State College students are eligible for as much as $6,961 and attendees of private nonprofit colleges could get up to $9,739.

West Virginia

In addition to a half-dozen scholarships, West Virginia houses three grant programs:

- Higher Education Grant: Although it’s a need-based award, applicants must demonstrate “academic promise.” As well as in-state institutions, the grant can also be used at approved schools in neighboring state Pennsylvania.

- Higher Education Adult Part-Time Student Grant Program: Award amounts vary depending on the student’s course load, but max out at $2,000. Adults returning to a four-year school or seeking a certificate or credential for a new career are encouraged to apply.

- West Virginia Invests: A “last-dollar” financial aid program that passed into law in 2019, it covers tuition and fees for associate’s degree and certificate programs leading toward in-demand careers.

Wisconsin

The state offers a number of grants that all come with traditional requirements, including being a resident. Not all grants are available at all schools, however.

Although award amounts are set annually by the state, here are more details about each of the grants:

- Wisconsin Grant: Divided between students attending public and private nonprofit schools, these grants offer between $250 and $3,150 in aid per year.

- Talent Incentive Program (TIP) Grant: Meant for “the most financially needy and educationally disadvantaged Wisconsin resident students,” this grant comes is worth between $600 and $1,800.

- Indian Student Assistance Grant: Undergraduate and graduate students with at least a quarter Native American heritage can receive between $250 and $1,100.

- Minority Undergraduate Retention Grant: Undergraduates of African American, Native American, Latino or Southeast Asian heritage can score between $250 and $2,500.

- Hearing & Visually Handicapped Student Grant: Undergraduate students with a significant hearing or visual impairment can qualify for between $250 and $1,800.

Wyoming

The state itself does not offer grants by name. However, a program funded by lawmakers and named for former Gov. Stanley Hathaway offers one need-based scholarship for community college and University of Wyoming students.

Applying for state grants for college

Unfortunately, the following three states don’t currently have active, publicly-funded grant programs:

- Nevada

- New Hampshire

- Utah

That’s not to say these states don’t offer resources. Nevada, for example, helps parents save up for their younger children’s college costs by providing matching funds through the Silver State Matching Grant.

But wherever you live, review your state’s aid options. For full details, you could click on the DOE’s map of contact information for each state’s department of education. You might also go directly to your (prospective) school. If you are looking for Texas grants for college and are enrolled at Texas State University, for example, you’d find the financial aid office’s listing of available grants.

Applying for state grants for college is an essential step in paying for your education — and it just might save you the trouble of taking out (more) student loans.