68% of Parents Would Use Retirement Savings to Pay for Child’s College

With college tuition in the U.S. at sky-high levels, many parents find themselves helping cover costs for school. After surveying more than 1,000 parents with children under 18, LendingTree found that an overwhelming 92% have either started saving for their child’s college or would like to start.

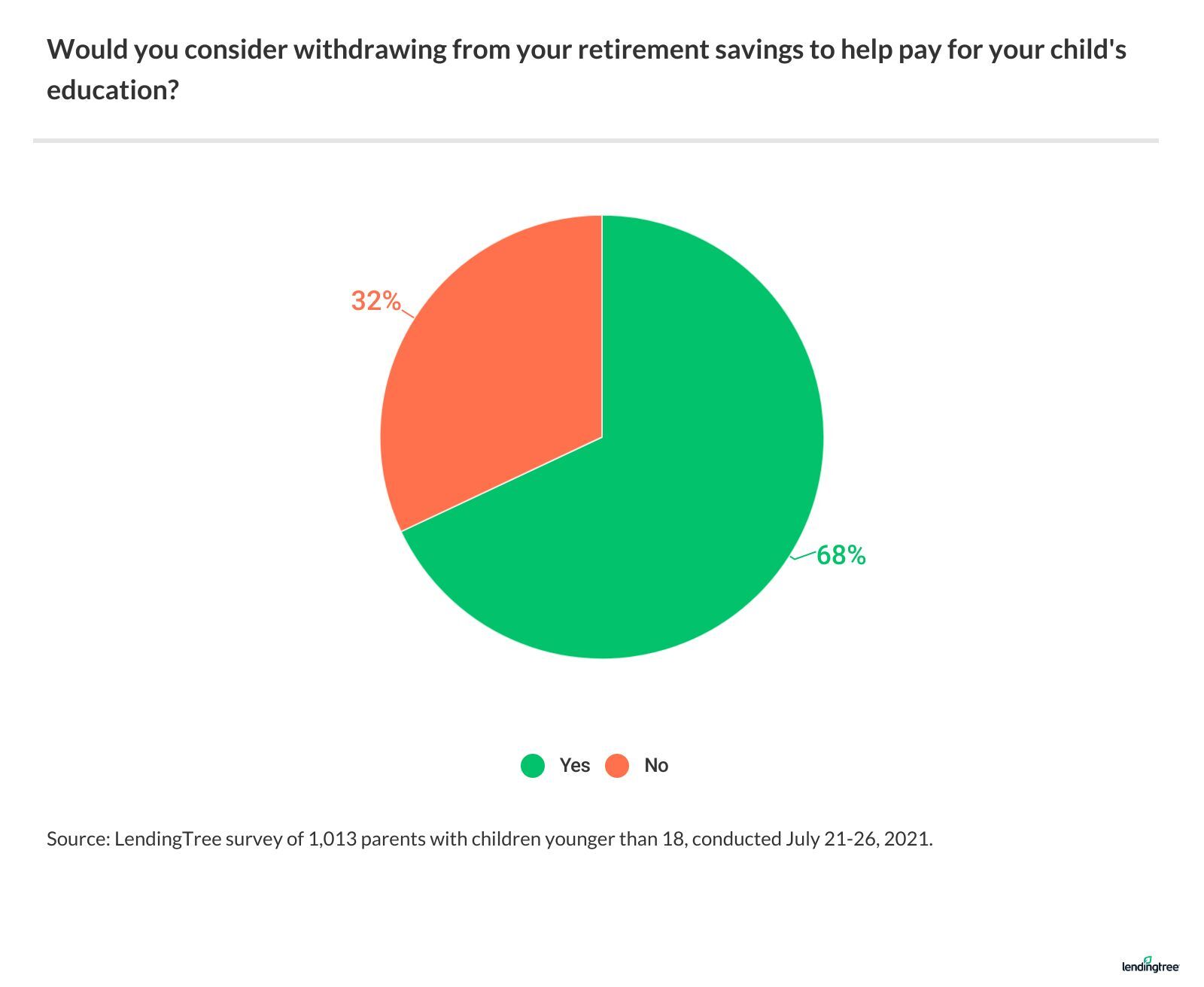

The looming price of tuition and other expenses is top of mind for many parents, with more than two-thirds saying they would consider using their retirement funds to pay for a child’s college costs.

Key findings

- 68% of parents would consider withdrawing from their retirement savings to help pay for their child’s education. (Read more)

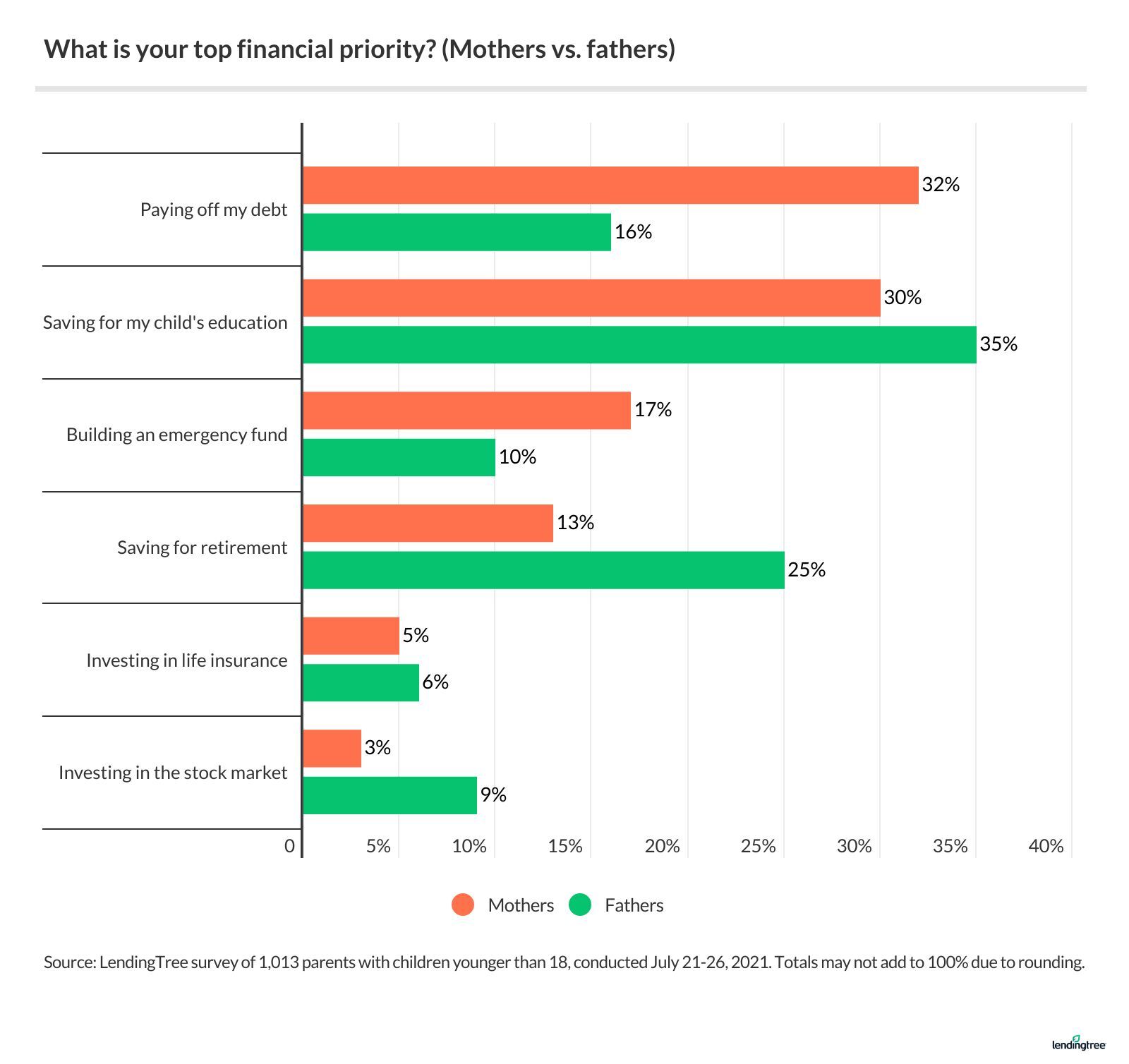

- 32% of parents say saving for their child’s education is their biggest financial priority. (Read more)

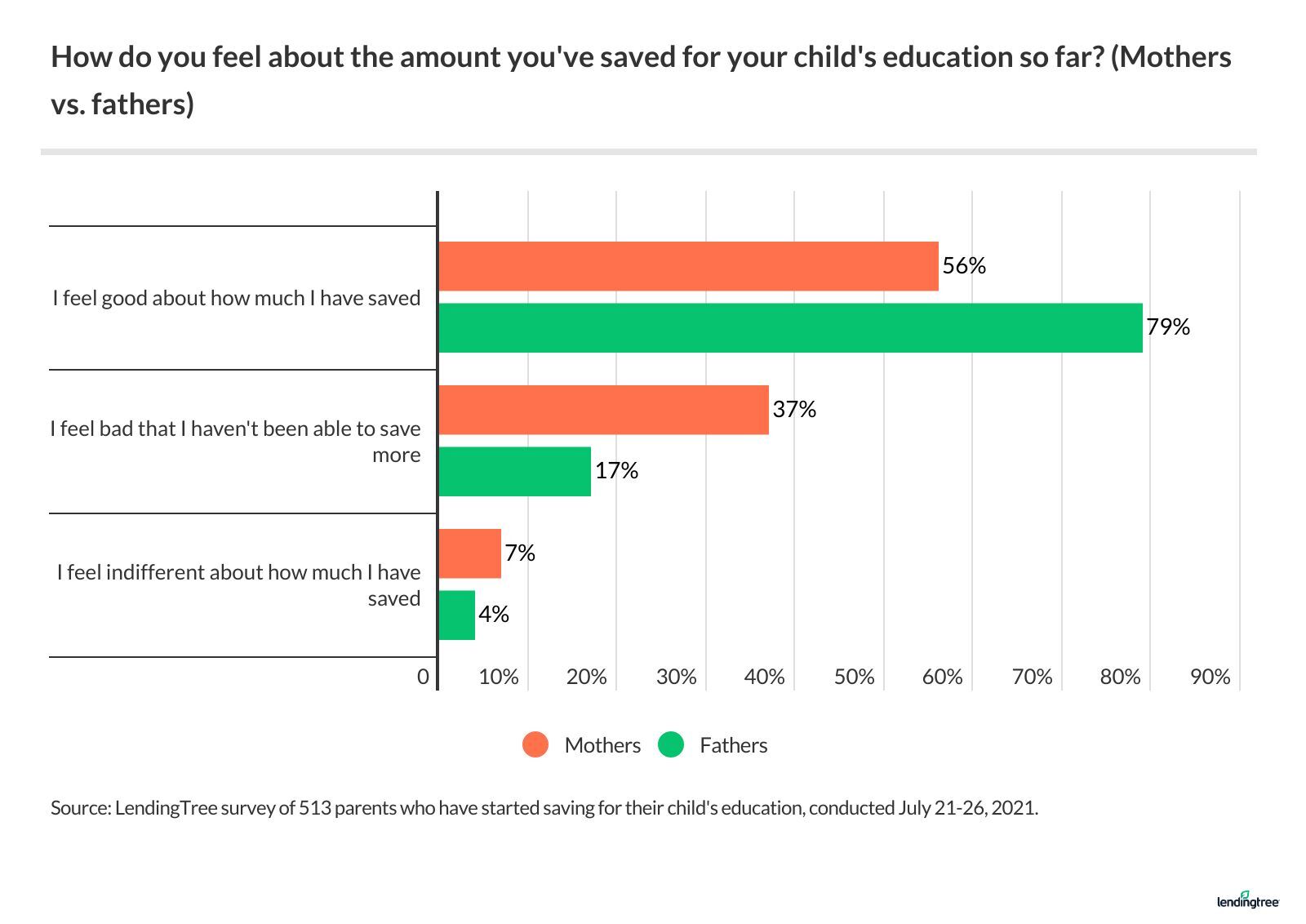

- Mothers feel more guilt about the amount of money they’ve saved for their child’s college education than do fathers. (Read more)

- Parents whose own parents helped pay for their education are more likely to have some money set aside for their child’s college education. (Read more)

- Of those who are saving for their child’s education, 37% started doing so even before their child’s first birthday. (Read more)

- Nearly three-quarters of parents saving for their child’s college education aren’t taking advantage of a 529 plan. (Read more)

Most parents would pull from retirement savings to help pay for college

While parents have a lot of competing financial commitments, including retirement to current debt, it’s saving for college that often seems to be at or near the top of the list.

According to our survey, 68% of parents would consider withdrawing from their retirement savings to help pay for their child’s education.

Fathers were especially likely to consider this option, with 74% saying they would consider using retirement funds versus 64% of mothers.

This option might make sense for some, since the IRS allows you to withdraw from your retirement savings to pay for qualified education expenses without penalty. However, draining your retirement savings could leave your own financial future less certain, so be sure to first carefully consider how doing so would impact your plans to retire.

Nearly one-third of parents see college as top priority

For some, saving for a child’s education is the most important financial task there is. According to our findings, 32% of parents said saving for college was their top priority, compared to 25% who selected paying off debt, and 18% who named saving for retirement.

In terms of other financial goals, fathers were more likely than mothers to put saving for retirement at the top of their list (25% versus 13%). Moms, however, were more likely to focus on paying off debt (32% versus 16%).

Other priorities included building an emergency fund (24%), investing in the stock market (6%) and investing in life insurance (5%).

Women feel more than guilty than men over college savings

Despite having to juggle a lot of competing financial goals, many parents say they’re happy with the amount of money they have saved for their child’s education — 70% said they felt satisfied.

Fathers were more likely to be confident with their level of college savings (79%) compared to mothers (56%). On the flip side, more than twice as many moms as dads said they felt bad about not having saved more (37% versus 17%).

Household income certainly helps when it comes to hitting goals for a college fund. Parents with six-figure household incomes were more than three times as likely to have some money saved for their child’s college than those earning less than $35,000 (76% versus 23%).

Parents’ own experiences affect college saving levels

Providing assistance for college tends to run in the family. Those whose own parents helped pay for their education seem to be more likely to have saved money for their child’s education.

- Among respondents whose own parents paid for their education in full, 80% said they had started saving for their kids to go to college.

- Among those whose parents paid for some of their education, 57% have started saving.

- For those who paid for college without parental help, 37% had begun a college fund of some kind.

While household income and other factors certainly play a role in how much parents can save for higher education, those who received such help in their past seem eager to pay it forward.

Many start saving for college before child’s first birthday, but goals are hard to reach

College tuition can be a huge expense, prompting many to start saving early. The survey found that 37% of parents began socking aside money for college before their child’s first birthday.

Among that group, 18% started saving before their child was even born.

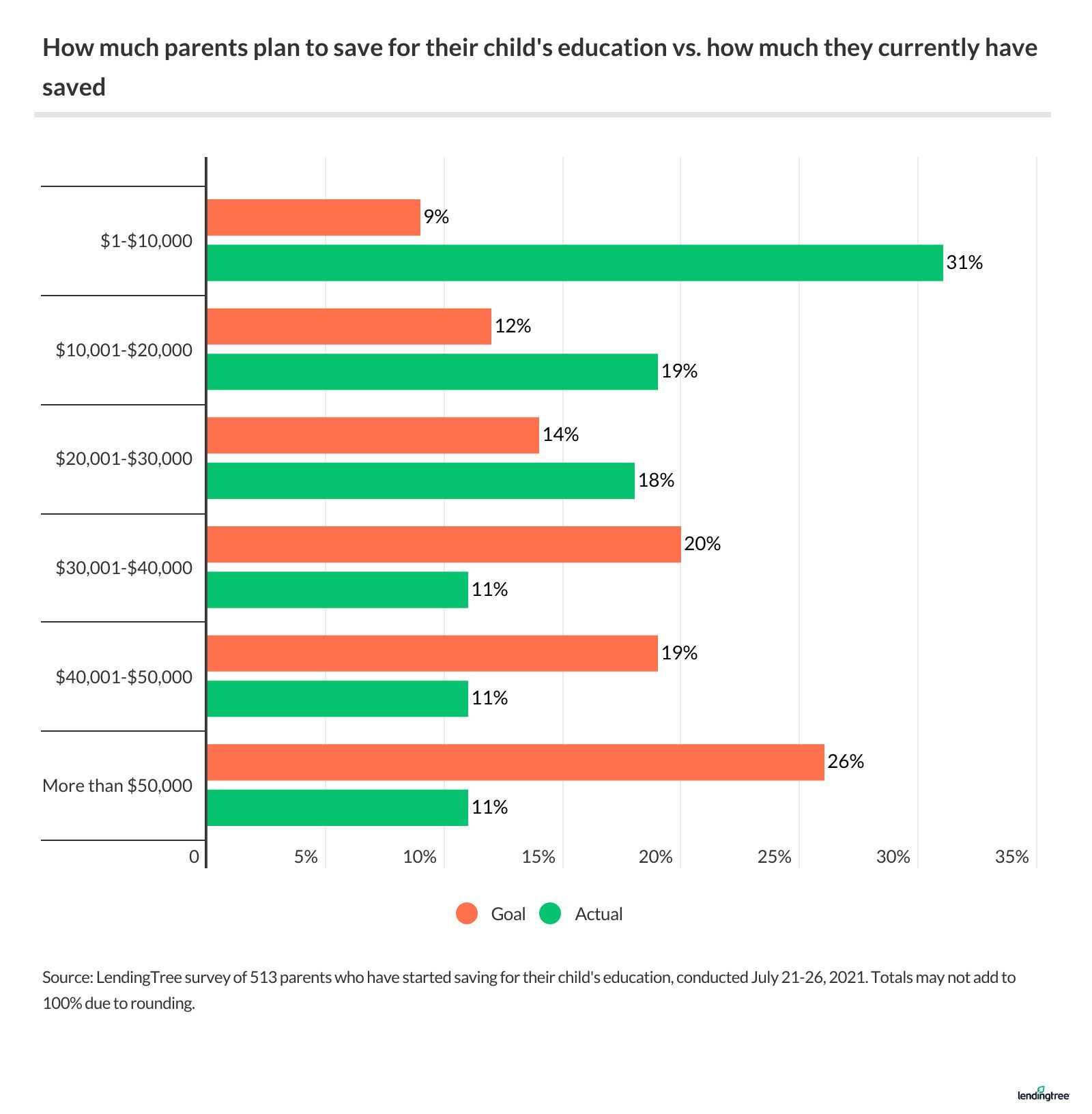

As for how much they hope to save, a majority of parents (65%) aim to have more than $30,000 put away. However, only 33% of those who had begun saving said they had $30,000 or more.

On the other end of the spectrum, nearly 31% of those who had started a college fund said they had $10,000 or less put together so far.

The cost for college can vary greatly, depending on the institution and the level of financial aid (including scholarships and grants). That said, $10,000 might cut it, as the median cost of just one year of a full course load at a four-year nonprofit college in 2020 was $12,720.

Most parents aren’t using 529 plans

While parents are working hard to save for their kids, relatively few show interest in using a tax-advantaged 529 plans. A 529 plan is an investment account that lets you use your earnings tax-free, so long as you spend them on qualified education expenses.

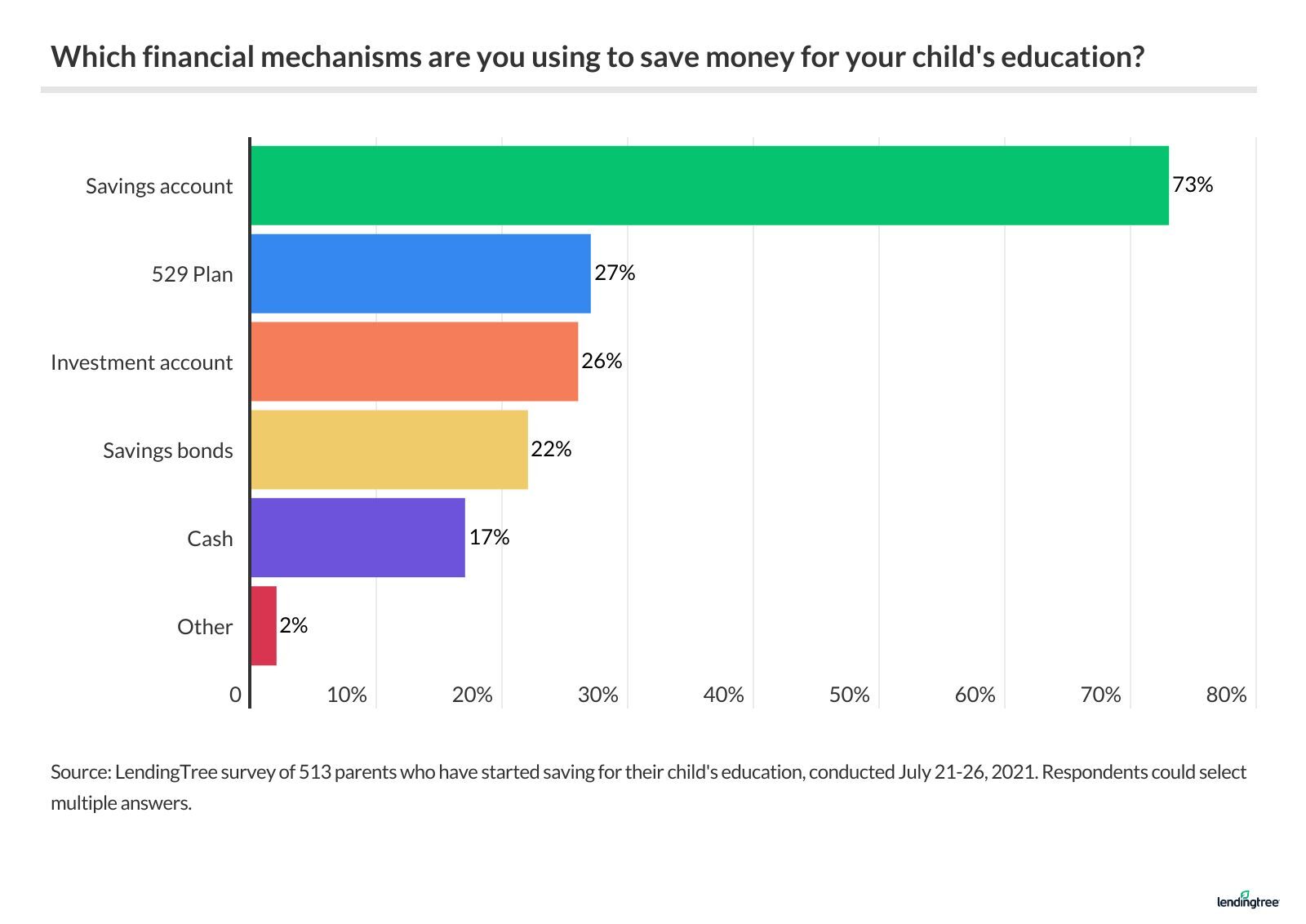

According to our survey, however, just under 27% of parents saving for their child’s college education were using a 529 plan. Instead, the vast majority (73%) had turned to regular savings accounts.

About 26%, meanwhile, said they were saving in an investment account, such as a mutual fund or IRA. Another 17% said they were saving in cash — usually not a preferred method, since the money won’t accrue interest over time. (In fact, cash could lose value over time due to inflation.)

If you’re saving for your child’s education, look closely at your options so you can pick one that makes your money go the furthest. For instance, have a look at 529 plans, as well as those with prepaid tuition plans which let you lock in today’s rates at certain public colleges. Our guide on 529 plan options explains more.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,013 parents with children younger than 18, fielded July 21-26, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.