Interest-Free Loans for Students: Why They Help and How to Find Them

Graduates from the class of 2019 who borrowed student loans left campus with an average balance of $29,900. Paying that back is intimidating enough before accounting for interest charges.

When you add interest, borrowers are on the hook for thousands — sometimes even tens of thousands — of dollars more in education debt. Fortunately, interest-free loans for students do exist.

- Interest-free loans for students: the basics

- How to find interest-free loans

- Where to get interest-free loans for students

- How to qualify for interest-free student loans

- How FAFSA helps get interest-free loans

- Drawbacks of interest-free loans for students

- Why a subsidized student loan is different

- Other alternatives to interest-free loans

- Choosing a loan that works best for you

Interest-free loans for students: How they work and some of their benefits

Interest-free student loans are exactly what they sound like: Loans that don’t accrue interest over time, so the amount you borrow is the amount you repay. Of course, these unique loans are not easy to find (or simple to get), but they are absolutely worth a look.

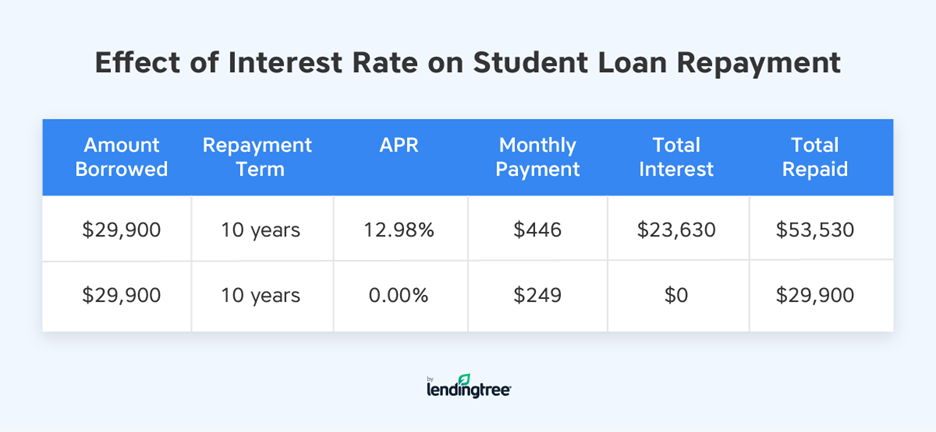

Interest-free loans for students have to be repaid just like traditional federal or private student loans. However, the APRs in our private loan marketplace, as of December 2021, go as high as 13.49%. Such a high rate could cause your loan balance to balloon, so interest-free student loans could help you save thousands.

For example, assume you had $29,900 in student loans on a 10-year repayment term at an APR of 13.49%. Your monthly payment would be $455. By the time you repaid the loan in full, you’d have repaid a total of $54,615. Thanks to your interest rate, you’d pay $24,715 in interest alone.

By contrast, if you had $29,900 in no-interest student loans and repaid them over 10 years, your monthly payment would be just $249. Even better, you’d pay only what you borrowed.

How to find interest-free loans

Like scholarships and grants, no-interest student loans are typically offered by nonprofit organizations, government agencies and private companies. The best way to discover interest-free loans for students is to check with the following sources:

- High school guidance counselors

- College financial aid offices

- Local chambers of commerce

- Rotary clubs

- Local nonprofits

- State education departments

- Fraternities or sororities

- Religious organizations

Be aware that many interest-free loans for students are limited to residents of certain geographic regions, which is why it helps to start your search close to home. Others, though, are open to pretty much anyone (provided you are a U.S. citizen).

Where to get interest-free loans for students

Foundations offering interest-free loans for students

Bill Raskob Foundation

You can get a no-interest student loan from the Bill Raskob Foundation if you are a U.S. citizen enrolled at an accredited school for the upcoming year. Undergraduates in their freshman year are not eligible.

Abe and Annie Seibel Foundation

Interest-free student loans are available from the Abe and Annie Seibel Foundation to students who are U.S. citizens and meet the following requirements:

- Must be a Texas resident who graduated from a high school in the state

- Must be enrolled full time at an accredited Texas college while working toward a first bachelor’s degree

- Must have graduated in the top 10% of their class or with an SAT score of at least 1100 or an ACT score of at least 23

- Must have a college GPA of at least 3.0

The Scholarship Foundation of St. Louis

The Scholarship Foundation of St. Louis provides interest-free loans for students who are:

- From the St. Louis metropolitan region

- Attending an accredited, nonprofit postsecondary institution

- Majoring in anything except ministry

Your financial aid office

Many foundations exist to assist students at a local level. Stop by your school’s financial aid office to see what opportunities may be available to you.

For example, at Sinclair Community College in Dayton, Ohio, you can access interest-free student loans through the Charles E. Schell Foundation Student Loan Program. Other programs can be found at both community and four-year colleges across the country.

Organizations offering interest-free loans for students

Military Officers Association of America

To qualify for a no-interest loan from the Military Officers Association of America (MOAA), you must be the child of an active duty, former or retired military officer eligible for MOAA membership or the child of active duty, Reserve, National Guard or retired enlisted military personnel.

Other requirements include:

- You are younger than 24. The maximum age is higher — up to five years — if you served in the military before completing college

- You have a high school GPA of at least 3.0

- You are not attending a U.S. military academy or academy prep school

- If a parent is a military officer, they must have paid their MOAA membership

- Male applicants are also encouraged to register for the Selective Service System

International Association of Jewish Free Loans

The International Association of Jewish Free Loans (IAJFL) collaborates with a variety of interest-free lending associations to issue interest-free loans for purposes such as higher education. Each serves its local geographical area and has its own underwriting requirements. Applicants do not need to be Jewish in order to qualify.

Leo S. Rowe Pan American Fund

The Leo S. Rowe Pan American Fund, offered through the Organization of American States, serves a demographic that isn’t usually eligible for interest-free student loans in the U.S.: citizens of Latin America and the Caribbean. Besides this requirement, students must also:

- Possess a student visa

- Study at an accredited postsecondary institution in the U.S.

- Plan on finishing their program of study within two years

Charitable trusts offering interest-free loans for students

Evalee C. Schwarz Charitable Trust for Education

To obtain an interest-free student loan from the Evalee C. Schwarz Charitable Trust for Education, you must:

- Be a U.S. citizen

- Attend a school in your home state

- Have test scores among the top 15% in the nation

- Qualify for grants via the Free Application for Federal Student Aid (FAFSA)

Colleges offering interest-free loans for students

Occidental College

If you are attending Occidental College, you may be offered an interest-free student loan from the school as part of your financial aid package.

Claremont McKenna College

Claremont McKenna College also issues interest-free student loans to students who qualify via its Office of Financial Aid.

State-specific programs offering interest-free loans for students

Massachusetts No-Interest Loan Program

U.S. citizens or non-citizens eligible under Title IV regulations who are residents of Massachusetts may qualify for the Massachusetts No-Interest Loan Program if they meet the following requirements, among other criteria:

- Must have filed their FAFSA

- Are seeking a certificate, associate degree or their first bachelor’s degree

- Male students must register with the selective service

- Must demonstrate financial need

Central Scholarship (Maryland)

Central Scholarship is a Maryland-based nonprofit offering scholarships and interest-free student loans to students who:

- Are Maryland residents

- Plan to attend an accredited U.S. college, community college or career school during the upcoming school year

- Have a GPA above 2.8

How to qualify for interest-free student loans

Every no-interest student loan comes with its own unique set of qualifications, but, generally, you could be expected to meet the following requirements:

- Financial need

- Completion of FAFSA

- U.S. citizenship

- Resident of a specific state

- High school graduate of a specific state

- Full-time enrollment at an accredited in-state school

- Specific field of study

- Solid academic record (such as GPA, class rank, test scores)

- Essay submission

- Personal interview

- Cosigner on the loan

Note that funds are very limited for interest-free student loans, so the sooner you apply, the better.

The FAFSA paves the way for interest-free loans

With funds so limited, the organizations that offer no-interest student loans want to see that you have already done everything possible to pay for school in other ways. The FAFSA is an essential part of that process.

The FAFSA not only assesses your need for student loans but also identifies financing options for you, including scholarships, Pell Grants and work-study programs.

FAFSA deadlines vary by state, so make sure you submit it on time to get all the aid you’re eligible to receive.

Keep in mind that your local government may also ask you to file a state-specific financial aid application. If you’re an Oregon resident, for example, you should also complete the Oregon Student Aid Application, or ORSAA.

Drawbacks of interest-free loans for students

As amazing as it sounds to pay no interest on a student loan, the benefit of saving money should be weighed against what you could be giving up.

Are interest-free loans really free?

If you take an interest-free loan, sometimes you may have to give up certain amenities student loans typically offer.

For example, if you receive an interest-free loan, you may be required to start paying back the loan while you’re still in school. On the other hand, when you have a federal student loan, you don’t have to start making payments until after you graduate.

You may also have to make higher payments with an interest-free loan than you would with a traditional student loan.

No federal protections

No-interest student loans don’t have the same protections you’ll get with a federal student loan. Ideally, you want to stay on the 10-year repayment plan, but if there comes a time when you just can’t make the monthly payment, the federal government gives you options.

Those options include income-driven repayment plans, as well as forbearance and deferment, that allow you to take a break from payments while you get your finances in order. You may miss out on all of that with an interest-free student loan.

Despite these drawbacks, interest-free student loans can help you save thousands over the length of your debt repayment. It’s a good idea to exhaust all your interest-free student loans, scholarship and grant opportunities to reduce how much you need to borrow in traditionally more expensive student loans.

No, a subsidized student loan isn’t an interest-free student loan

Federal Direct Subsidized Loans, which are awarded to lower-income students who complete the FAFSA, are technically interest-free throughout repayment. The government covers — or subsidizes — the interest on these loans only while you’re enrolled at least half-time, during your six-month grace period following graduation or in certain periods of deferment. Otherwise, interest accrues on subsidized loans as it does with other federal and private loans.

Interest-free student loans, by comparison, are the only type of education debt that is truly interest-free. That’s because your balance won’t grow from the time you borrow until you’ve finished repayment.

Alternatives to interest-free loans

Personal loan

A personal loan from a bank or credit union can help you to cover school expenses. Personal loans typically come at a minimum of $1,000 and, while some loan terms can go as high as 144 months for some lenders, personal loans typically come with terms between 12 and 60 months.

Many lenders will offer the opportunity for you to check if you prequalify for a loan via a soft-credit check. Be sure to compare offers — specifically APR rates, terms and monthly payment amounts — to ensure you get a proposal that best fits your financial situation.

0% APR credit card

Some credit card companies offer 0% intro APR credit cards. This 0% APR rate is typically only available for a certain period of time. This can range anywhere from 12 months to 21 months. Keep in mind, however, that once the 0% APR rate promotion is over, you’ll have to pay interest on the remaining balance left on your card.

Like with applying for a personal loan, you’ll want to compare credit card offers as well. Be sure to check with the financial institutions you already bank with as, in some instances, you may prequalify for certain credit cards with enticing rewards.

401(k) loan

If you have a 401(k) account, you may be able to borrow or withdraw money from it to pay for school. Some companies may only allow you to borrow or withdraw money under circumstances, and, in some cases, using that money toward school expenses such as tuition.

However, there are some risks and penalties that may be involved with borrowing against your 401(k) account. You may have to pay taxes on the amount you borrow or even fees. There may also be a withdrawal limit on how much you can borrow from your 401(k).

Choosing a loan that works best for you

While interest-free loans for students sound like a dream come true, they’re not without their pitfalls. Like with taking out a personal loan or shopping for a credit card, you may want to compare offers should you be eligible for any interest-free loans. Jumping the gun and snatching up any type of loan (whether or not it has interest) without fully considering the terms could land you in financial trouble down the road.