How to Decide If Establishing Residency for In-State Tuition Is Worth the Hassle

Earning a college degree can get expensive — especially if you have to pay out-of-state tuition. In 2022, the average four-year public university cost $26,382 for those out of state versus $9,212 for those in state, according to the Education Data Initiative.

If you’d like to pay that lower price tag, here’s how to prove in-state residency for college, as well as other ways to cut costs.

5 pros and cons of establishing residency for college

| Pros | Cons |

|---|---|

If you qualify, you could save big on college costs. A gap year could be a great life experience. | In-state residency is not guaranteed. You may need to give back some financial aid. You’ll have to move away from your home state. |

1. Pro: If you qualify, you could save serious money

The biggest benefit of applying to establish residency for tuition purposes in your school’s state is the cold, hard cash savings. It’s more expensive to attend a state school as an out-of-state resident — and some states are pricier, on average, than others.

The average out-of-state tuition can be almost three times the price of in-state tuition, the Education Data Initiative has reported.

You won’t just save money outright by establishing residency, but also likely lower your total amount of student debt. Going to school as an in-state resident can also mean you’ll need fewer student loans to cover college costs. Graduating with less student loan debt is a definite plus.

2. Pro: A gap year might be a great experience

Because many states require that you live there for at least a year before applying for residency for college, you might find yourself considering spending a gap year in the state where your dream school is located. You might do this before you even apply to the college, or you may defer enrollment after being accepted, if you can work with your school to do so.

You’ll need to be serious about establishing residency so as to not appear as though you are doing so simply to gain in-state tuition privileges. Get a driver’s license or state ID, get a job, find an apartment (even if that means having several roommates to save money) and become a truly involved citizen of your new state.

Putting off your dream to attend college for a year or more might not be ideal. However, the time away from campus could allow you to become truly financially independent and put yourself in your best possible position for a lower tuition.

You could also consider joining AmeriCorps. In addition to receiving a financial award for your education, you can petition your school for residency after completing your AmeriCorps volunteering experience.

3. Con: In-state residency is not guaranteed

Even after going through stacks of paperwork and moving from one state to another, securing in-state status is not a sure thing.

It’s an especially difficult process for young people who are often still dependent on their parents for financial support; often they would need to establish full financial independence to be considered. This is much harder to do at 18 as a high school graduate than it is as an adult at 25.

Schools also review your application based on evolving state residency requirements and then make a unilateral decision. An appeals process might also be handled by the same group of people who could deny you in the first place.

No matter your new home state and school, ensure you have every detail covered in the application process.

4. Con: You might have to give back some financial aid

Changing your residency status as a student could force you to give back some or all of the financial aid you have received, particularly if you earned it from another state.

If you’re a New York native moving to Boston, for example, you might have to give up any state grant aid you received from your home state before Massachusetts can adopt you as its own. Your school might also cancel or change the aid it promised in your initial award letter as a result of your new residency and lower tuition costs.

Keep this in mind when comparing financial aid offers and calculating the difference between in-state and out-of-state tuition. A University of Massachusetts Amherst student, for example, could save almost $25,000 per academic year on in-state tuition (which is $33,325 including room and board) versus out-of-state tuition ($57,701 including room and board). But those savings might actually be lower considering this caveat.

5. Con: You’ll have to cut ties with your home state

Consider what else you might be giving up by establishing residency for college in a new state. You’d lose your home state voting privileges, for example. And, if you’re trying to establish residency while you are already enrolled in college, you might need to stay there during summer vacation in order to qualify.

You might also experience other significant financial effects from switching states. Moving to a city with no state or municipal income taxes could be a big win. But what if you’re moving to a high-tax state?

One workaround to keep residency in your home state while still saving on college costs: If you want to attend a neighboring state’s school, consider regional tuition exchange programs: It’s one of many ways to pay less in tuition.

The Western Interstate Commission for Higher Education, for example, teams up with 16 states, including Arizona, California, Oregon and Washington, to deliver reduced tuition costs to out-of-state students.

How to establish residency for college

Now that you know some pros and cons, you may be wondering just how to establish residency for college in another state and how to be considered “in state” for college tuition.

First off, you should know that you can’t establish residency in another state simply by living in a dorm room for a year or more. However, you may be able to request to change your residency classification after you have been attending your school for a specific period of time. This means that while you might begin as an out-of-state student, you may become an in-state student and receive the tuition benefit in a later year.

The first step toward establishing residency in your school’s state is to get a handle on your school’s requirements. Many schools make their criteria accessible online, either through the registrar’s office, bursar or financial aid website. If you can’t find yours, contact your school’s financial aid office.

Schools typically take cues from their respective state’s Board of Regents. However, schools within the same state might interpret directions differently.

Most of all, they’re concerned with your domicile — this is a fancy word defining your physical presence in a state and your intent to stay. Schools want to ensure your in-state residency will continue after you’ve received your diploma and that you intend to make their state your permanent home.

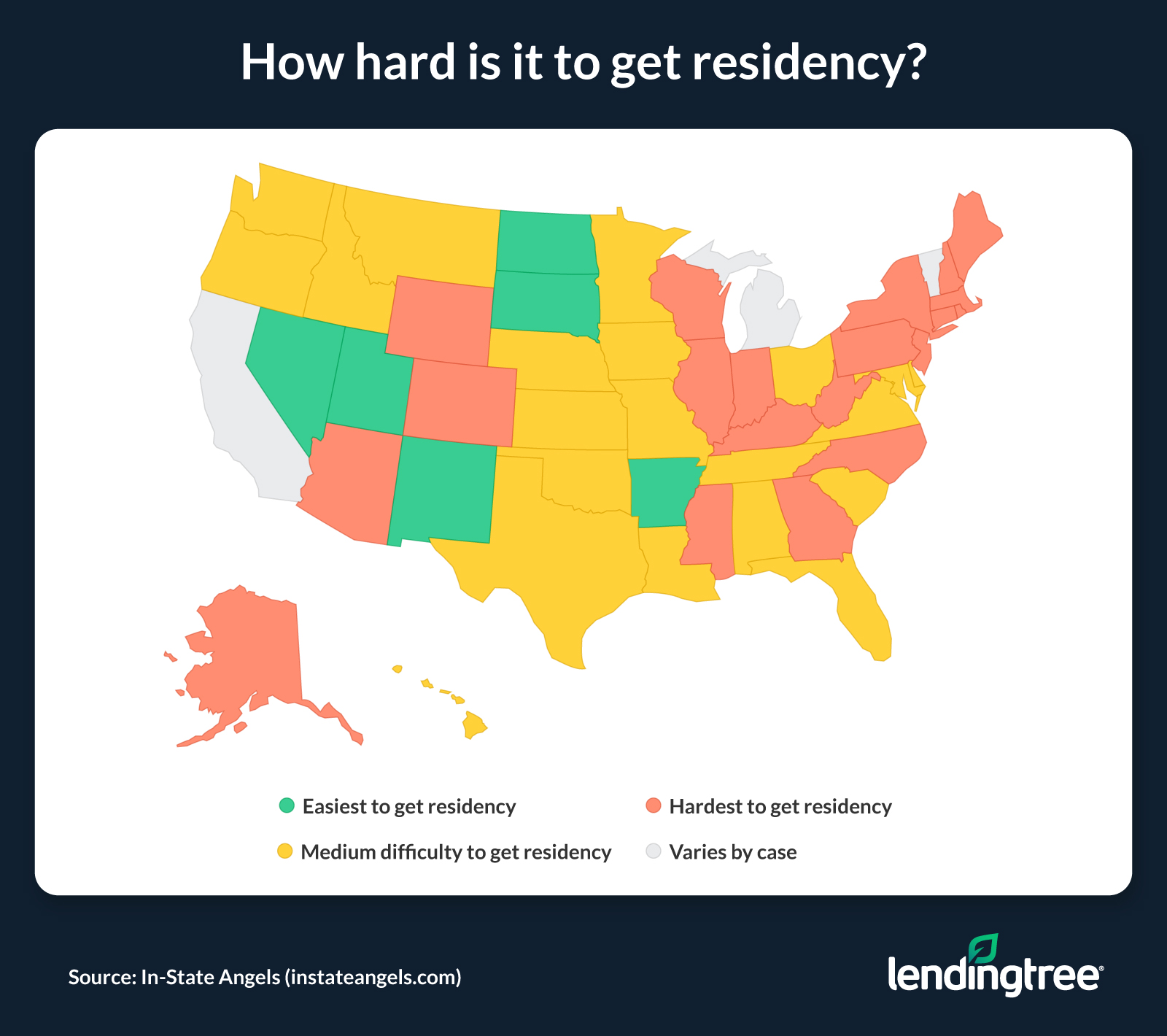

Not all states are as welcoming to applicants as others. The map below shows how easy or difficult it is to become a state resident, based on information from In-State Angels, a company that helps students get residency.

Independent students in tougher-to-apply states — such as Arizona, Colorado and Alaska — will likely have to clear a higher bar in proving their financial independence in order to achieve lower state tuition rates.

How to establish residency for in-state tuition: Gather these documents

No matter your status, you could be expected to provide documents as part of your application.

Typical documents you might need include:

- Voter registration card

- Driver’s license and vehicle registration

- Residential rental lease or real property record

- State income tax returns

- Declaration of Domicile from the county clerk

Even seemingly trivial pieces of paper, like a library card or a hunting or fishing license, can help prove your residency for college, as well as your intent to live in the state long term.

Some schools do offer far easier ways to receive in-state tuition for out-of-state students. A Northwestern Oklahoma State University nonresident undergraduate, for example, could have their out-of-state tuition waived by maintaining a 2.0 GPA or better. In addition, the University of Missouri offers a scholarship that waives in-state tuition requirements for students whose biological, adoptive or stepparent attended the school.

So, before looking to establish residency for in-state tuition at your preferred campus, you should find out whether the school offers a similar opportunity to qualify for in-state rates.

All that said, applying for residency as a noncitizen or nonpermanent resident of the United States may be more challenging. If your desired school won’t approve residency in your case, consider DACA financial aid and other opportunities that don’t require citizenship or a green card. Your financial aid office should be able to point you in the right direction.

Other ways to cut college costs

Establishing residency for in-state tuition is one way to save money and avoid a high amount of student debt. But proving residency for college isn’t possible or ideal for everyone, and it’s far from the only way to cut your college costs.

For one, you can consider a variety of gift aid using scholarship search tools. You might also consider the numerous loan forgiveness programs out there, particularly if you’ve already borrowed student loans and are considering entering a field in which you’ll be of service to others. Certain military personnel may also be able to access veteran benefits.