How Does Student Loan Interest Work?

If you have student loan debt, you know how quickly your balance can grow due to interest charges. But how does student loan interest work?

For federal student loans, Congress sets the interest rates. Meanwhile, with private student loans, lenders establish their own rates.

But regardless of the type of loan(s) you have, a portion of every student loan payment goes toward the interest. In fact, depending on your interest rate and other factors, the majority of your payment may cover interest rather than the principal.

Understanding how student loan interest can affect your loan repayment is a key to paying off your loans quickly.

To learn more, let’s answer these questions:

- How does student loan interest work?

- When does interest start on student loans?

- How is student loan interest calculated?

- How is student loan interest applied?

- What happens if you don’t make full payments each month?

- How are extra student loan payments treated?

- What does student loan interest mean to me?

How does student loan interest work?

When you take out a federal or private student loan, the lender will require you to sign a promissory note that explains the terms of the loan. Every part of this document is important to read and understand, as it determines how much you owe and when your payments are due.

Here’s what you’ll need to look out for:

- Disbursement date. The disbursement date is when the lender disburses the loan. In most cases, the disbursement date is also when the loan will begin accruing interest.

- Amount borrowed. The amount borrowed is how much you took out to cover your loan costs. It may be different than the amount you receive if the lender deducts disbursement fees.

- Interest rate. Your interest rate is what you pay to borrow money, which is depicted as a percentage. Federal student loan interest rates are set by Congress, based on what’s being charged on the bond market. Private student loan interest rates, meanwhile, will vary by lender.

- Fees. Your loan may have additional fees, such as late payment fees or disbursement fees.

- How interest accrues. The promissory note for your loan will state whether interest accrues daily or monthly.

- How interest capitalizes. The loan agreement details when accrued interest is capitalized to your principal balance. When interest is capitalized, it gets added to your balance — interest will then accrue based on the new, higher amount.

- First payment date. The promissory note will list when your first payment is due. Depending on the type of loans you use, you may need to make payments while you’re in school, or you could be allowed to defer payments until after graduation.

- Grace periods. Depending on the type of loan you have, you may receive a grace period — a time after leaving school where you don’t have to make payments on your loans. For example, most federal loans have six-month grace periods. But not all loans have grace periods, so be sure to read the promissory note carefully.

- Payment schedule. The payment schedule is the number of payments — and the frequency at which you’ll have to pay them. For instance, the standard repayment plan for federal student loans runs 10 years, with one payment per month.

When does interest start on student loans?

The type of loans you have effects when interest will begin accruing.

- Federal subsidized. Students with significant financial need may qualify for federal subsidized loans. With subsidized loans, the government pays the interest while you’re in school, during your grace period and any periods of deferment. Interest only begins accruing once you leave school and your grace period ends.

- Federal unsubsidized. With federal unsubsidized loans, the borrower is responsible for all interest charges. However, you don’t have to make payments until after you leave school.

- Federal PLUS. Available to graduate and professional students, as well as parents borrowing on behalf of a child, federal PLUS loans begin accruing interest immediately after disbursement.

- Private. Though some private student loan lenders allow you to postpone payments until after you graduate, interest will usually accrue on your loans while you’re in school.

How is student loan interest calculated?

While all federal student loans have fixed interest rates, private student loans can have fixed or variable interest rates. When you take out a private loan, you can decide which type you want. The interest rate type can affect your payments and how much interest accrues.

Your interest rate is divided by the number of days in the year to get your “interest rate factor.” The interest rate factor is then multiplied by your loan balance, and then multiplied by the number of days since your last payment. The result is how much interest you’re charged for that period. For example:

3.65% (interest rate) / 365 = 0.01 x $1000 (balance) x 30 (days since last payment) = $300 charged in interest

Fixed rates

With a fixed-rate loan, your monthly payment is theoretically the same for the duration of your repayment term. Your payment goes toward interest first, then any remaining money is directed to the principal balance.

Variable rates

Variable interest rates can change over time, based on debt market conditions. As the rate fluctuates, it can cause your monthly required payment to increase too. While variable rates are often lower than fixed interest rates initially, they can end up being much higher, making them riskier options for borrowers.

How is student loan interest applied?

As you make payments on your student loan, your balance and the amount of interest you accrue will drop. While your first payments after disbursement will primarily go toward the interest, more of your payments are applied to your principal over time.

Over the life of your loan, the amount of interest you pay will decline each month, which accelerates your principal payment. That’s how it works with student loan amortization — basically a fancy way of saying “paying down principal on a loan.”

Remember, your payment amount goes toward interest and any outstanding fees before it reduces your principal.

If you’re on an extended payment plan, or if you’ve deferred your payments, interest continues to accrue — unless you qualify for an eligible deferment on federal subsidized loans — and the loan servicer will add the interest to your loan balance.

If possible, it may make sense to pay at least the interest that accrues each month. Otherwise,

your loan balance will continue to grow and you’ll owe interest on the interest you didn’t pay in previous months. In fact, making interest payments while you’re in school can save you money in the long run.

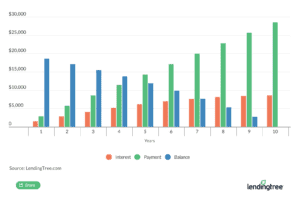

The impact of interest is even more pronounced when you think of high-interest loan types, such as some private student loans or PLUS loans. For example, PLUS loans disbursed on or after July 1, 2022 through July 1, 2023, have a 7.54% interest rate. Let’s say you take $5,000 in parent PLUS loans for each of the four years your child is in school. Here’s how the interest builds up with a 7.54% interest rate:

To pay for your child’s education, you borrowed $20,000 over four years. Assuming a 7.54% interest rate and starting repayment right after disbursement, you’d repay a total of $28,539 over 10 years — interest would add over $8,500 to your loan cost.

What happens if you don’t make full payments each month?

It’s important to remember that making partial payments will count as a missed or late payment on your credit report and may cause you to go into loan default.

How default is handled varies based on the loan type. With federal loans, all outstanding interest is capitalized (though this was halted during the federal loan repayment pause, begun as a result of the coronavirus pandemic). There may also be late fees and collection costs.

If you can’t afford your payments, explore your options as soon as you realize you’re struggling. With private student loans, contact your lender to see if you’re eligible for an alternative payment plan.

If you have federal student loans, you may be eligible for an income-driven repayment (IDR) plan that bases your payments on a percentage of your discretionary income and provides a longer repayment term. If you still have a balance at the end of your IDR repayment term, the government will discharge the remaining balance.

Another option is to defer your payments. When you enter deferment, you can temporarily postpone your payments for several months. However, interest will continue to build on all loans, with the exception of federal subsidized loans.

For example, consider the scenario with parent PLUS loans. You have $5,000 in debt at 7.54% and defer for 12 months. In that case, deferment would add $377 to the total when you’re on a 10-year repayment.

While it’s possible to defer payments when you have a parent PLUS loan, the fees and interest might mean it makes more sense to avoid it if you can make room in your budget to keep paying down your debt, or even looking into student loan refinancing at a lower interest rate, if possible.

How are extra student loan payments treated?

If you make extra payments and don’t include any special instructions, your loan servicer will automatically apply the excess amounts to accrued interest. If there’s money left over, it’ll usually apply the payment to the principal of the loan with the highest interest rate.

However, you can direct your loan servicer to handle payments differently. You can contact the servicer and ask to have the payment applied to a different loan — for example, if you’re using the debt snowball strategy to pay off your debt, you can request that extra payments go toward the loan with the smallest balance.

You can also request that the servicer applies extra payments only to the principal. In this situation, it’s recommended by the National Consumer Law Center’s Student Loan Borrower Assistance Project that you submit your request in writing, then double-check with your lender to ensure your principal-only payments are appropriately applied.

And don’t underestimate the power of early student loan payments — paying an extra $50 or $100 each month can save you thousands of dollars in interest, depending on your loan terms. Check out the student loan prepayment calculator to see how much you can save by paying a little more every month.

What does student loan interest mean to me?

How does student loan interest work? It’s a common question, but now that you understand how compound interest works, focus on strategies that allow you to reduce the interest that accrues.

Making extra payments, taking advantage of autopay discounts and student loan refinancing could all help you in paying off your loans faster and saving money.