Debt in the Bedroom: Survey Shows 32% of Student Loan Borrowers Report Decreased Libido

Have you ever worried what your student loan debt might do to your future or current relationship? It’s not unusual for money to throw a wrench in a couple’s future plans, but just how big of a problem is it?

We wanted to find out, so we asked more than 1,000 borrowers about their experiences with student loan debt and relationships. Here’s what we learned.

Relationships and student loans: key findings from our survey

One of the biggest hurdles of serious relationships is trying to get two individuals on the same page on nearly every important topic under the sun. Inevitably, clashes happen.

But is student loan debt the barrier to relationships we seem to think it is? Maybe not.

Most couples work on student loan debt together

More than 43 percent of survey respondents said they fight about money with their partners at least “somewhat often.” Given the fact that debt is a large source of stress among individuals, it’s no surprise that it can lead to strain for couples.

Unfortunately, a money-avoidance pattern arises due to this stress:

- More than one-third (36 percent) of respondents admitted to having lied to a partner about money.

- What’s more, 24 percent have kept their student loans a secret from their partner.

- And 18 percent said it’s okay to lie to a partner about money.

On the positive side, being open and honest about student loan debt has helped some couples work together:

- Partners are jumping in, with 55 percent saying their partners helped out in making debt payments.

- They’re also working together on their finances, with 39 percent saying they pool their money into one main account.

- And still another 29 percent said they have both joint and separate accounts.

Couples report a decrease in their sex drive due to debt

But even working together on student loan debt can take a toll. After all, federal student loan repayment plans can last anywhere from 10 to 30 years. Even if you pay off your debt early, you could be in for a long haul.

The stress brought on by this kind of debt can take a toll on mental health. And one victim of that toll could be your libido. Approximately one-third of respondents claimed to have experienced a decrease in their sex drive due to student loan debt.

Student loan debt isn’t the biggest financial deal breaker

As in my case, many people carrying student debt fear that their loans could singlehandedly destroy their relationship. The results of this survey, however, show something quite different.

More than one-third of respondents said that when it comes to deciding whether to get serious with someone, how they handle their debt could be a deal breaker. Less than one-quarter said having a high amount of debt would be a deal breaker.

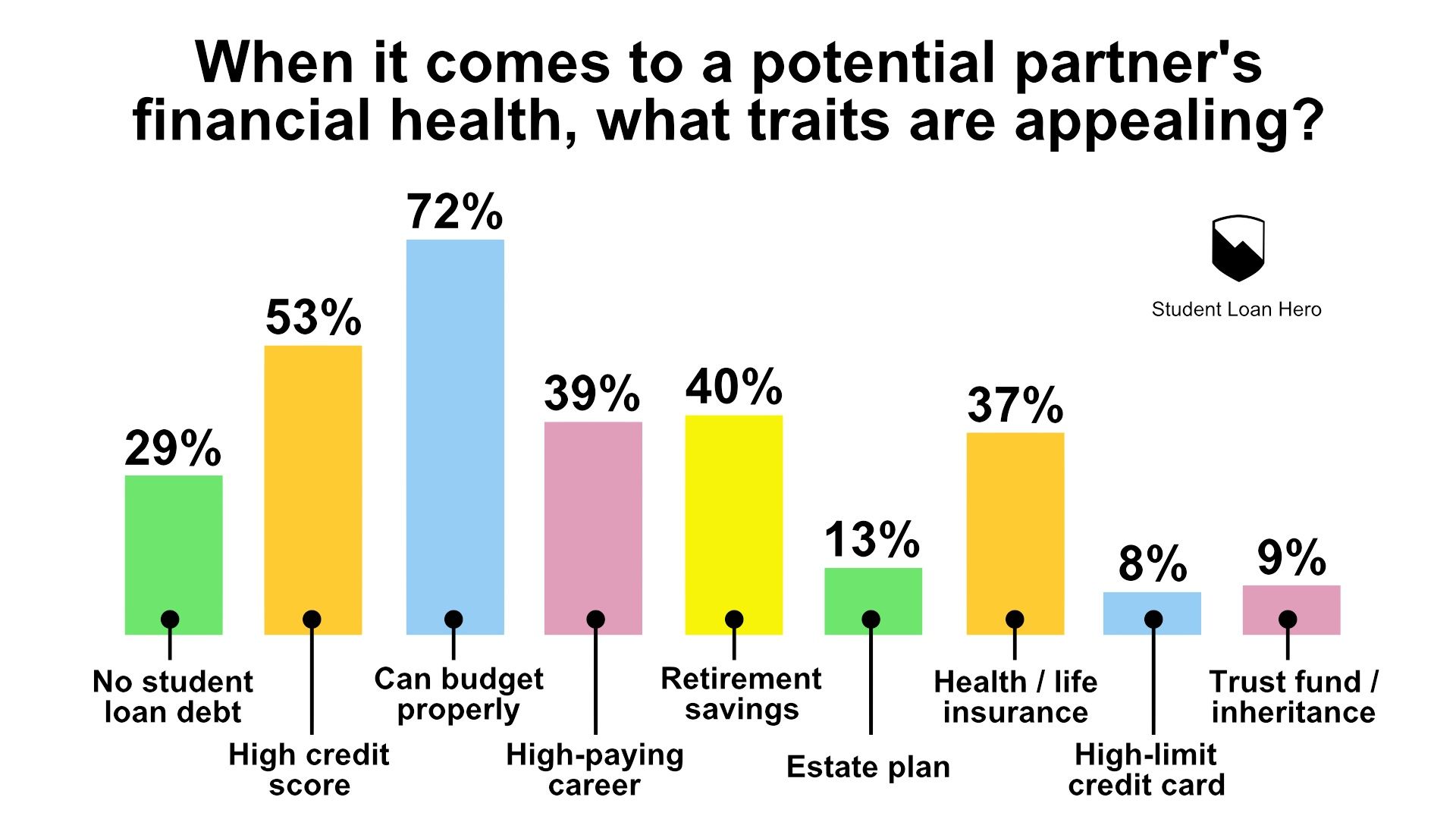

Perhaps even more encouraging, only 29 percent said the most appealing trait in a potential partner’s financial health is “zero student loan debt.” Compare that to the 72 percent who said the ability to budget properly was the most appealing financial trait.

As for other financial factors that student loan borrowers found appealing:

- Having a high credit score came in second place with 53 percent of the vote.

- Holding a retirement account came in third with 40 percent of the vote.

All of this points to a desire to see a strong financial foundation — and how having a plan for the future can be far more important to potential partners than not having debt today.

But student loans are, in fact, delaying major relationship milestones

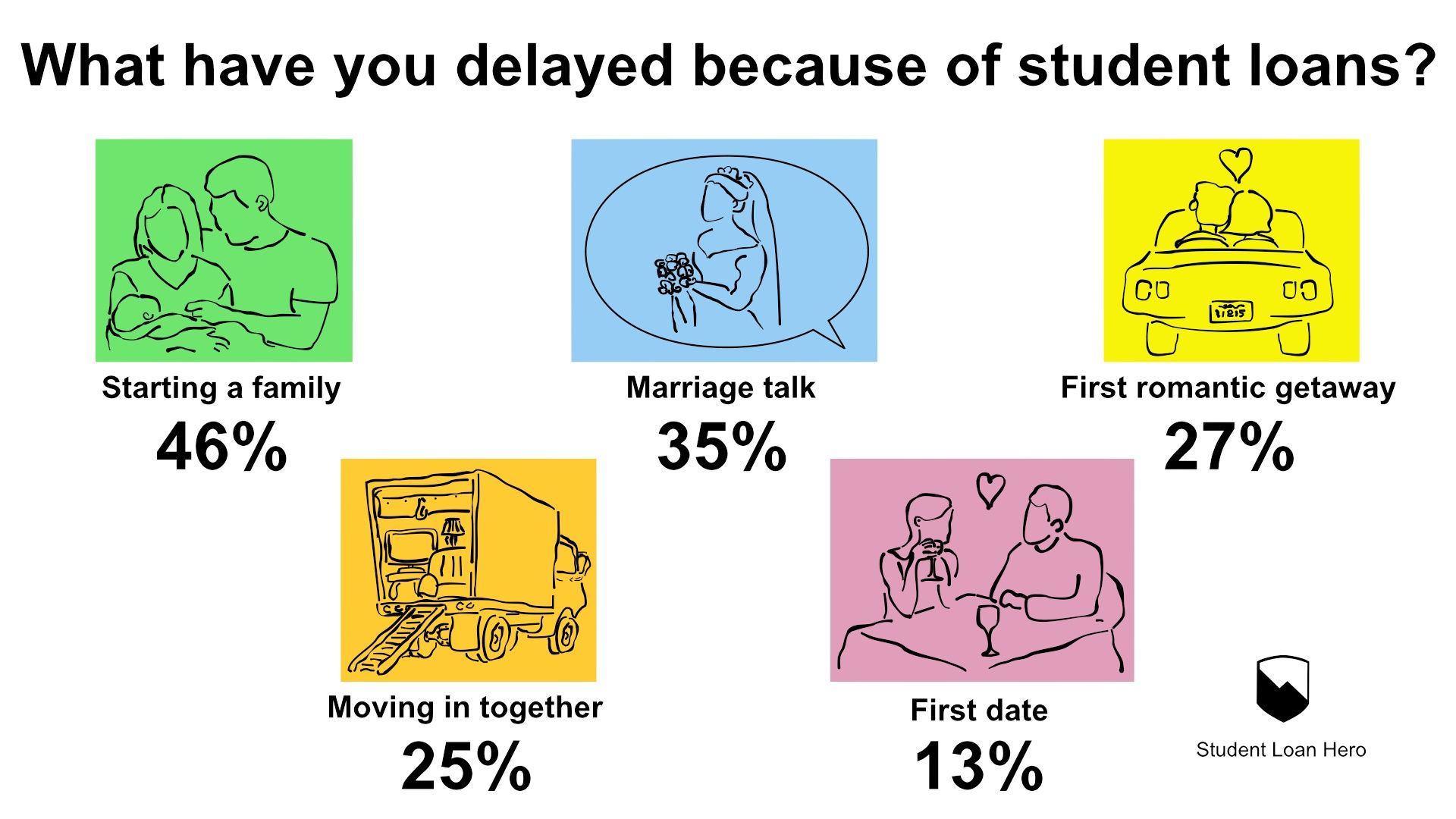

It’s important to mention that, although student loan debt isn’t necessarily a ruiner of relationships, it can cause a delay in major life and relationship milestones.

One-quarter of respondents put off moving in with a partner because of student loan debt. Another 35 percent delayed “the marriage talk.” And 46 percent delayed starting a family.

How to overcome the challenges of student debt together

So what can you do with these findings? Know that, although student loan debt can strain you, your love life doesn’t have to suffer for it. Instead, show that you have a plan of action for the debt — that way your partner (or future partner) can feel encouraged that the situation is under control.

Here are a few tips from marriage and couples counselors to help.

Reframe the situation

To start, banish the emotions that can so often come with student loan debt, such as feeling burdened, frustrated, angry, scared, or ashamed. Know that having debt does not make you a failure — and delaying certain life milestones might not be so bad.

Erin Wiley, a licensed professional clinical counselor, explained how you and your partner can find the positive in your situation:

“Instead of bemoaning not being able to buy a home yet, or start trying for a baby, celebrate the freedom of not having to mow your lawn or fix your gutters, and of being able to go out with friends at a moment’s notice. … Enjoy the time you have without commitments like a house and kids, and embrace the freedom it gives you.”

Be open, honest, and vulnerable

If you haven’t told your partner about your debt, and the relationship is getting serious, now’s the time to put your cards on the table. Financial behaviorist Jacquette Timmons encourages leaning into the vulnerability of that first financial talk:

“The goal with these types of conversations shouldn’t be to avoid the fear and awkwardness that comes with it. That’s natural! It goes with the territory of being vulnerable — whether you’re the person initiating the conversation or not.”

But she also mentions why you should be confident about your ability to resolve the debt:

“Even if you feel bad about your debt, you don’t need to defend yourself. I think that is a mistake that too many people make when it comes to sharing information that doesn’t shine the most positive light on them, or about which they feel self-conscious.”

That said, if you’re still too worried about sharing the truth about your debt, understand the gravity of not doing so if you’re planning a life together. Shawna Young, a licensed marriage and family therapist, said that it’s critical for couples to have an open-door policy when it comes to finances:

“Financial infidelity can lead to mistrust and be as harmful as physical or emotional infidelity. Therefore, an honest and open policy is of the utmost importance in a relationship, especially a marital relationship.”

Seek help together if you’re feeling overwhelmed

Let’s say you had the talk, or have been having the talk over and over again, and you’re just not getting anywhere. It might be time to look for help.

One way to get help is to talk to a marriage or couples counselor. Wiley explained why doing so sooner rather than later is best:

“Most therapists agree: Couples usually show up in counseling about seven years too late for the state their marriage is in. If you’re struggling, don’t wait — get help now.”

Besides a marriage counselor, you can also seek out a qualified financial planner to work out a road map for your money. Once you have a direction and steps to follow, it’s a lot easier to turn frustration into empowerment and see real progress as you work together for your future.

Finally, know that being in it together is your best chance of success. Don’t hide in feelings of shame if you have debt, and don’t pass judgment if your partner has debt. Licensed clinical professional counselor Rabbi Shlomo Slatkin emphasized the strength in working as one unit:

“Couples who are committed to making it work can weather even the most challenging of financial times. It’s not always easy, but with the right tools and the desire to make it work, they can stop the stress of debt from torpedoing their marriage.”

Remember, this is just one of many hurdles you’ll have to overcome in your lives together. Learning how to do it with money matters will only strengthen your relationship. Work out a financial plan as a couple, speak honestly about your feelings, and seek help if you need it.

There can be a time when all this is a distant memory and you’ll be able to enjoy the real prize: a happy life together.